Connecticut Gets Medieval All Over Construction Defects

February 10, 2012 —

CDJ STAFFThe Hartford Courant reports that Connecticut is trying a very old tactic in a construction defect suit. The law library building at the University of Connecticut suffered from leaks which have now been repaired. The state waited twelve years after was complete to file lawsuit, despite that Connecticut has a six-year statute of limitations on construction defect claims. Connecticut claims that the statute of limitations does apply to the state.

� The state is arguing that a legal principle from the thirteenth century allows it to go along with its suit. As befits a medieval part of common law, the principle is called “nullum tempus occurrit regi,” or “time does not run against the king.” In 1874, the American Law Register said that nullum tempus occurrit reipublicae “has been adopted in every one of the United States” and “is now firmly established law.”

� In the case of Connecticut, Connecticut Solicitor General Gregory D’Auria said that “the statute of limitations does not apply to the state.” He also noted that “the state did not ‘wait’ to file the lawsuit. The lawsuit was filed only after all other options and remedies were exhausted.”

� Connecticut also argued that “nullus tempus occurrit regi” applied in another construction defect case at the York Correctional Institution. The judge in that case ruled in December 2008 to let the case proceed. But in the library case, Judge William T. Cremins ruled in February 2009 that the statute of limitations should apply to the state as well. Both cases have been appealed, with the library case moving more quickly toward the Connecticut Supreme Court.

Read the full story…

Read the court decisionRead the full story...Reprinted courtesy of

NY State Appellate Court Holds That Pollution Exclusions Bar Duty to Defend Under Liability Policies for Claims Alleging Exposure to PFAS

February 01, 2022 —

Robert F. Walsh & Paul A. Briganti - White and Williams LLPOn January 6, 2022, the New York Supreme Court, Appellate Division, Third Department, held that the “sudden and accidental” pollution exclusion (SAPE) and “absolute” pollution exclusion (APE) in liability policies relieved two insurers of a duty to defend the insured-manufacturer in connection with claims alleging damages as a result of exposure to perfluorooctanoic acid (PFOA) and perfluorooctane sulfonate (PFOS), which are man-made chemicals within the group of per- and polyfluoroalkyl substances (PFAS). See Tonoga, Incorporated v. New Hampshire Insurance Company, No. 532546, 2022 N.Y. App. Div. LEXIS 105 (App. Div. 3rd Dep’t Jan. 6, 2022).

In Tonoga, starting in 1961, the insured and its predecessors owned and operated a manufacturing facility in Petersburg, New York that produced materials coated with polytetrafluoroethylene (PTFE). Until 2013, the manufacturing process involved the use of PFOA and/or PFOS. In early 2016, excessive PFOA and/or PFOS concentrations were detected in Petersburg’s municipal water supply. Later that year, the New York Department of Environmental Conversation designated the insured’s facility a Superfund site, and the insured entered into a consent agreement that required it to assist in remedial measures. 2022 N.Y. App. Div. LEXIS 105, at *1-2.

Reprinted courtesy of

Robert F. Walsh, White and Williams LLP and

Paul A. Briganti, White and Williams LLP

Mr. Walsh may be contacted at walshr@whiteandwilliams.com

Mr. Briganti may be contacted at brigantip@whiteandwilliams.com

Read the court decisionRead the full story...Reprinted courtesy of

Possible Real Estate and Use and Occupancy Tax Relief for Philadelphia Commercial and Industrial Property Owners

September 07, 2017 —

James Vandermark & Kevin Koscil - White and Williams LLPA recent decision by the Pennsylvania Supreme Court puts in jeopardy all of the recent real estate tax reassessments completed by the City of Philadelphia for tax year 2018 as well as appeals initiated by the School District of Philadelphia in 2016 for tax year 2017.

The City’s current practice is to certify the market values of any reassessed properties to the Board of Revision of Taxes on March 31st prior to the year that the assessment would be implemented. The City then relies on those certified values to determine the applicable tax rate when it creates its budget each summer. Accordingly, the Office of Property Assessment (OPA) submitted the values applicable for the 2018 tax year to the BRT on March 31, 2017. The City set the applicable tax rates during its summer budget sessions. However, unlike prior years, this year the City only reassessed commercial and industrial properties and excluded residential properties. The result was reported to be an increase of over $118 million in new real estate taxes.

Shortly after the City finished its budget, the Pennsylvania Supreme Court decided the case of Valley Forge Towers Apartments N, LP, et al. v. Upper Merion Area School District. The case involved a challenge by property owners to the Upper Merion School District’s practice of only appealing assessments on commercial properties. As with the recent reassessments by the City, Upper Merion was only seeking to increase the real estate tax assessments for high value commercial properties. The Pennsylvania Supreme Court found that the school district’s practice violated the Uniformity Clause in the Pennsylvania Constitution. The court reaffirmed the principle that real estate within a jurisdiction should be treated as a single class and that tax authorities are not permitted to discriminate against commercial and industrial properties in favor of residential properties for purposes of real estate taxation.

Reprinted courtesy of

James Vandermark, White and Williams LLP and

Kevin Koscil, White and Williams LLP

Mr. Vandermark may be contacted at vandermarkj@whiteandwilliams.com

Mr. Koscil may be contacted at koscilk@whiteandwilliams.com

Read the court decisionRead the full story...Reprinted courtesy of

Condemnation Actions: How Valuable Is Your Evidence of Property Value?

November 06, 2018 —

Erica Stutman - Snell & Wilmer Real Estate Litigation BlogWhen a government condemns (takes) private property for a public use, the property owner is entitled to receive “just compensation” equal to the property’s market value. Value is typically determined by appraisals, but if the parties cannot agree, a judge or jury will determine the amount in a condemnation lawsuit. The parties may seek to present various forms of evidence of value, though it will be admissible only if the evidence is relevant and its value is not substantially outweighed by the risk of causing unfair prejudice, confusion, undue delay or waste of time, does not mislead the jury, and is not needlessly cumulative. See, e.g., Fed. R. Evid. 403.

Read the court decisionRead the full story...Reprinted courtesy of

Erica Stutman, Snell & WilmerMs. Stutman may be contacted at

estutman@swlaw.com

Top 10 Lessons Learned from a Construction Attorney

February 18, 2015 —

Craig Martin – Construction Contractor AdvisorI have had the pleasure of working with

Cordell Parvin, who in his earlier career was a preeminent construction attorney, and now,

coaches attorneys. Cordell has shared countless construction guides and presentations with me over the years, for which I am extremely grateful. Below is Cordell’s Lesson’s Learned list, that is as true today as when he drafted it years ago.

1. Contracts and owners are not all alike. Some are fairer than others. Some create greater risks of making the budget if we encounter changes, delays and impacts. We should appreciate the risks before bidding and not underestimate indirect costs of staff to deal with these situations.

2. It is important to have a thorough understanding of the Contract Administration requirements of complex contracts. Identifying specifically what must be done when changes, delays and differing site conditions are encountered is one way to establish the understanding.

3. If a project ever ends up in court, every letter, note, e-mail and memo is evidence and will be taken out of context by the opposing lawyer. Recording every mistake, miscalculation, problem or lesson learned during construction of the project will come back to haunt you.

Read the court decisionRead the full story...Reprinted courtesy of

Craig Martin, Lamson, Dugan and Murray, LLPMr. Martin may be contacted at

cmartin@ldmlaw.com

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

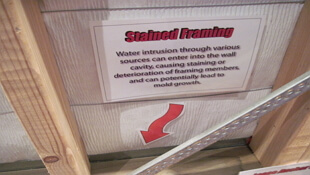

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

On Rehearing, Fifth Circuit Finds Contractual-Liability Exclusion Does Not Apply

November 26, 2014 —

Tred R. Eyerly – Insurance Law HawaiiOn rehearing, the Fifth Circuit determined that the contractual-liability exclusion did not apply to bar coverage for damage caused by the insured contractor to the home it constructed. Crownover v. Mid-Continent Cas. Co., 2014 U.S. App. LEXIS 20727 (5th Cir. Oct. 29, 2014).The court withdrew its prior opinion, summarized here.

Arrow Development, Inc. contracted with the Crownovers to construct a home. The contract had a warranty-to-repair clause, which, in paragraph 23.1, provided that Arrow would "promptly correct work . . . failing to confirm to the requirements of the Contract Documents." After the Crownovers moved in, cracks began to appear in the walls and foundation of the home. Additional problems with the heating, ventilation, and air conditioning ("HVAC") caused leaking in the exterior lines and air ducts inside the home. To compensate for defects in the HVAC system, the system's mechanical units ran almost continuously in order to heat or cool the home. Because they were overburdened, the mechanical units had to be replaced. The Crownovers paid several hundred thousand dollars to fix the problems with the foundation and HVAC system.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com

First-Time Homebuyers Make Biggest Share of Deals in 17 Years

February 22, 2018 —

Prashant Gopal – BloombergMillennials are playing homeownership catch-up.

First-time buyers rushed into the market last year, making 38 percent of all U.S. single-family home purchases, the biggest share since 2000, data released Thursday by Genworth Mortgage Insurance show. The 2.07 million new or existing homes bought by first-timers was 7 percent more than in 2016, according to the insurer, part of

Genworth Financial Inc.

Read the court decisionRead the full story...Reprinted courtesy of

Prashant Gopal, Bloomberg