20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

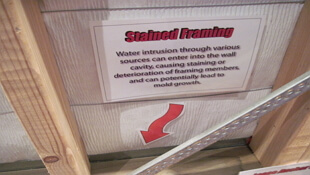

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

Amazon Urged to Review Emergency Plans in Wake of Deadly Tornado

June 20, 2022 —

Spencer Soper - BloombergAmazon.com Inc. should better prepare workers for extreme weather events, according to federal regulators who investigated a deadly tornado strike on a company warehouse in Edwardsville, Illinois.

The storm ripped through the facility in December, killing six workers and injuring several others, prompting the Occupational Safety and Health Administration to launch a probe. At the time, Amazon said the facility complied with all construction regulations and that proper safety procedures were followed when the tornado struck. But several workers told Bloomberg that training for such events was minimal and mostly entailed pointing out emergency exits and assembly points.

An OSHA report released on Tuesday echoed those concerns. The agency said a bullhorn that was supposed to be used to tell workers to take cover was locked up in a cage and inaccessible. In interviews with investigators, some employees couldn’t recall ever participating in emergency drills and said they mistakenly took shelter in a bathroom on the south side of the building rather than in designated restrooms on the north side.

Read the court decisionRead the full story...Reprinted courtesy of

Spencer Soper, Bloomberg

Coverage Denied for Ensuing Loss After Foundation Damage

February 07, 2014 —

Tred R. Eyerly – Insurance Law HawaiiThe insureds attempt to secure coverage for ensuing losses after foundation damage was properly denied by the insurer. Walker v. Nationwide Prop. & Cas. Ins. Co., 2014 U.S. Dist. LEXIS 6683 (W.D. Tex. Jan. 6, 2014).

Two provisions excluding coverage under Nationwide's homeowner's policy were key to the court's decision. Exclusion 3 (e) barred coverage for "continuous or repeated seepage or leakage of water or stem over a period of time . . . ." Exclusion 3 (f) (6) precluded coverage for settling, cracking, shrinking, bulging or expansion of pavements, patios, foundations, walls, floors, roof or ceiling.

The policy also included a Dwelling Foundation Endorsement which covered settling, cracking, bulging of floor slabs or footings that supported the dwelling caused by seepage or leakage of water or steam. This endorsement stated the limit of liability would not exceed an amount equal to 15% of the limit of coverage for the dwelling.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com

Dispute Over Exhaustion of Primary Policy

May 20, 2015 —

Tred R. Eyerly – Insurance Law HawaiiIn a dispute between the excess and primary carriers, the Fifth Circuit determined the primary policy was exhausted, triggering coverage under the excess policy. Amerisure Mut. Ins. Co. v. Arch Spec. Ins. Co., 2015 U.S. App. LEXIS 6627 (5th Cir. April 21, 2015).

Amerisure issued a CGL policy to Admiral Glass & Mirror Co. The policy provided excess over any coverage under a controlled insurance program policy. Arch issued an Owner Controlled Insurance Program (OCIP) policy to Endeavor Highrise, LP and to its contrators and subcontractors for bodily injury and property damage arising out of the construction of the Endeavor Highrise. Admiral was a subcontractor insured under the OCIP.

The OCIP had combined bodily injury and property damage limits of $2,000,000 per occurrence, a general aggregate limit of $2,000,000 and a products-completed operations aggregate limit of $2,000,000. The OCIP contained a Supplementary Payments provision which provided that Arch would pay "[a]ll expenses we incur" in connection with any covered claim, and that "[t]hese payments will not reduce the limits of insurance." Endorsement 16, however, expressly deleted and replaced this statement with: "[supplementary payments] will reduce the limits of insurance." The OCIP also provided that Arch's duty to defend ended "when we have used up the applicable limit of insurance in the payment of judgments or settlements."

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com

Revisiting Statutory Offers to Compromise

August 28, 2023 —

Kathryne Baldwin - Wilke FleuryThe fourth appellate district published an opinion earlier this year in Smalley v. Subaru of America, Inc. (2022) 87 Cal.App.5th 450 that serves as an excellent refresher on requirements of the “998 Offer,” or a statutory offer to compromise pursuant to Code of Civil Procedure (“CCP”) §998.

In Smalley, set in the context of a Lemon Law action, Defendant Subaru made a 998 Offer for $35,001.00, together with attorneys’ fees and costs totaling either $10,000.00 or costs and reasonably incurred attorneys’ fees, in an amount to be determined by the Court. (Smalley, supra, 87 Cal.App.5th at 454.) Plaintiff objected that the offer was not reasonable and the case proceeded to trial. At trial, a jury found in favor of Plaintiff and awarded him a total judgment award of $27,555.74 – far short of the $35,001.00 offer. The trial court found Plaintiff had failed to beat the 998 at trial and that Subaru’s earlier 998 offer was reasonable. Plaintiff appealed the post-judgment order awarding Plaintiff pre-offer costs and Defendant post-offer costs on the grounds that the 998 was not reasonable in that it did not specify whether Plaintiff would be deemed the prevailing party for purposes of a motion for attorneys’ fees. The fourth district affirmed the trial court’s order and engaged in a helpful review of 998 requirements.

Read the court decisionRead the full story...Reprinted courtesy of

Kathryne Baldwin, Wilke FleuryMs. Baldwin may be contacted at

kbaldwin@wilkefleury.com

Housing Buoyed by 20-Year High for Vet’s Loans: Mortgages

July 23, 2014 —

Prashant Gopal and Jody Shenn – BloombergDuring his third deployment in Afghanistan, Air Force Staff Sgt. Claude Hunter was so eager to return to the U.S. and buy a house that he signed a contract for a property that his agent showed him over Skype.

Hunter got back in time to close the deal, paying $219,000 in May for the four-bedroom Waldorf, Maryland, house that he financed with a U.S. Department of Veterans Affairs mortgage. It didn’t require a down payment.

“On Facebook, my friends have started posting: ‘I got my VA loan, I got my house,’” said Hunter, 31. “Everybody is just ready. A lot of them have done their jobs overseas and are coming home.”

America’s fragile housing recovery is getting a boost from military buyers using VA mortgages as the U.S. draws down troops after more than a decade of combat in Iraq and Afghanistan. About 4.7 million full-time troops and reservists served during the wars and many are now able to take advantage of one of the easiest and cheapest paths to homeownership. The program’s share of new mortgages, at a 20-year high, is also increasing as other types of government-backed loans have grown more costly.

Mr. Gopal may be contacted at pgopal2@bloomberg.net; Ms. Shenn in New York at jshenn@bloomberg.net

Read the court decisionRead the full story...Reprinted courtesy of

Prashant Gopal and Jody Shenn, Bloomberg

This Is the Most Remote and Magical Hotel on Earth

May 12, 2016 —

Sarah Hepola – BloombergThere are no signs leading to the Fogo Island Inn. That’s how hard it is to miss the place. Designed by architect Todd Saunders, who grew up in nearby Gander, the building takes its inspiration from the fishing shacks that dot the shoreline, sagging on old wooden stilts, but it was also made with the dimensions of a cruising vessel. Three hundred feet long by 30 feet wide. Like a ship that’s just sailed into harbor.

For decades, the flow of traffic in this community off the Newfoundland coast had moved in one direction: away. Fewer than 2,500 people live on an island four times the size of Manhattan. But the inn, the brainchild of Fogo Island native and tech millionaire Zita Cobb, reversed that trend when it was completed in 2013. Strangers now come from around the world to see the island, whose unspoiled landscape makes it a coveted spot for the under-the-radar traveler.

Read the court decisionRead the full story...Reprinted courtesy of

Sarah Hepola, Bloomberg

Negligence Per Se Claim Based Upon Failure to Pay Benefits Fails

December 21, 2016 —

Tred R. Eyerly – Insurance Law HawaiiThe Ninth Circuit affirmed the district court's issuance of the insurer's motion for summary judgment, thereby rejecting the insureds' negligence per se claim for failure to pay benefits. Braun-Salinas v. Am Family Ins. Group, 2016 U.S. App. LEXIS 19555 (9th Cir. Oct. 28, 2016).

The insureds argued that Oregon recognized a negligence per se claim based on an insurer's failure to pay benefits in violation of the statutory standard under state law. Oregon appellate courts, however, only allowed a negligence per se claim only where a negligence claim otherwise existed. The Oregon courts had previously rejected a statutory theory, holding that a violation of the statute did not give rise to a tort action.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com