Construction Defect Scam Tied to Organized Crime?

July 31, 2013 —

CDJ STAFFThe Las Vegas Review-Journal reports that the initial tip-off came from Scott Canepa, a construction defect attorney who alerted the FBI about Leon Benzer’s activities in taking over homeowner boards. Canepa learned that Nancy Quon was taking part in the scheme and went to the FBI with the information. After FBI officials met with Canepa, they launched an investigation, which they named “Operation GrandMaster.”

Although a Benzer associate stated that Benzer claimed not to have ties to organized crime, and according to the Review-Journal, “preferred to think of himself as ‘just a bully,’” the case involves connections to a number of figures with ties to organized crime. Benzer with associated with John V. Spilotro, a lawyer whose uncle was an alleged overseer for Chicago organized crime operating in Las Vegas in the 70s and 80s. Another conspirator, Paul Citelli, reportedly has ties to organized crime in Buffalo.

Read the court decisionRead the full story...Reprinted courtesy of

An Upward Trend in Commercial Construction?

March 28, 2012 —

Melissa Brumback, Construction Law in North CarolinaYear-end economic indicators demonstrate that private commercial construction may be increasing in 2012, primarily as demand grows for new projects built in the United States.

�According to an article in Businessweek, the Architecture Billings Index held at 52 in December, indicating a modest expansion in the market. The American Institute of Architects said that the commercial and industrial component of the number climbed to 54.1 in December, the highest in 10 months.

�The monthly survey of U.S.-based architecture firms is one of the main indicators of nonresidential construction, and these numbers suggest that modest improvement may be on the horizon.

�The information is confirmed by data from the Census Bureau that shows that spending on lodging, office, commercial and manufacturing buildings grew 8.2 percent in November to $9.2 billion from a year ago. These types of commercial and industrial projects are historically canaries in the mine and are usually the first part of the industry to improve as the economy expands.

Read the full story…

��Reprinted courtesy of Melissa Dewey Brumback of Ragsdale Liggett PLLC. Ms. Brumback can be contacted at mbrumback@rl-law.com.

Read the court decisionRead the full story...Reprinted courtesy of

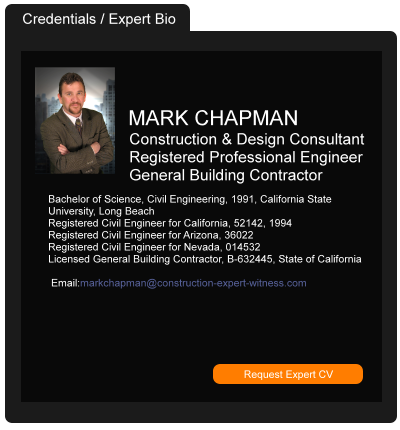

Reconciling Prompt Payments and Withholding of Retention Payments

March 30, 2016 —

Eric J. Rollins, Esq. – Newmeyer & Dillion, LLPIt is common in California for the owners of a project to make monthly payments to a contractor for work as it is completed, but withhold a certain percentage as a guarantee of future satisfactory performance. Contractors almost always pass these withholdings on to their subcontractors. Unsurprisingly, disputes can arise regarding when the withheld retentions must be paid.

Civil Code section 8814, subdivision (a), states that a direct contractor must pay each subcontractor its share of a retention payment within ten days after receiving all or part of a retention payment. However, an exception exists -- a direct contractor may withhold from the retention paid to a subcontractor an amount not in excess of 150 percent of the estimated value of the disputed amount, whenever a “good faith dispute exists between the direct contractor and a subcontractor.” (See Cal. Civ. Code, § 8814, subd. (c).) The problem with the statute is that it offers no help in defining a “good faith dispute,” and the California courts have historically not provided much guidance either. Can a “good faith dispute” be any dispute between the contracting parties, e.g., a dispute regarding change orders, mismanagement, etc.? Or must the dispute relate specifically to the retention? Unfortunately for California litigants, the answer may depend on the appellate district in which the parties find themselves.

Read the court decisionRead the full story...Reprinted courtesy of

Eric J. Rollins, Esq., Newmeyer & Dillion, LLPMr. Rollins may be contacted at

eric.rollins@ndlf.com

Senate’s Fannie Mae Wind-Down Plan Faces High Hurdles

March 19, 2014 —

Clea Benson, Cheyenne Hopkins and Kathleen Hunter – BloombergA bipartisan U.S. Senate plan to dismantle Fannie Mae (FNMA) and Freddie Mac must clear many political hurdles in a short time if it is to become law, leaving narrow chances of a housing-finance overhaul being enacted this year.

Senate Banking Committee leaders said the proposal, which they plan to release later this week, would replace the two U.S.-owned mortgage financiers with government bond insurance that would kick in only after private capital suffered severe losses.

It will be left to the courts to decide how investors in Fannie Mae and Freddie Mac are treated as the two companies are wound down, Mike Crapo, an Idaho Republican who co-wrote the bill, said today in an interview on Bloomberg Television. Investors including Perry Capital and Fairholme Capital Management are suing the U.S. to challenge an arrangement in which all the companies’ profits go to the Treasury.

Ms. Benson may be contacted at cbenson20@bloomberg.net; Ms. Hunter may be contacted at khunter9@bloomberg.net; Ms. Hopkins may be contacted at chopkins19@bloomberg.net

Read the court decisionRead the full story...Reprinted courtesy of

Clea Benson, Cheyenne Hopkins and Kathleen Hunter, Bloomberg

Designers “Airpocalyspe” Creations

May 19, 2014 —

Beverley BevenFlorez-CDJ STAFFBlaine Brownell in Architect Magazine discussed how recently some designers have created items to deal with urban pollution, however, the creations themselves are more politically-charged than practical.

Brownell lists recent examples of architects and designers “perverse” creations: “Notable smog-inspired works include the Aegis Parka, a protective jacket created by Dutch design studio Nieuwe Heren; a palladium dichloride coat that changes color in the presence of carbon dioxide emissions and is designed by London-based artist Lauren Bowker; and R&Sie(n)’s ‘Dustyrelief’ building in Bangkok, designed to collect atmospheric dust via an electrostatically-charged facade.”

“Perhaps such proposals—and the disarming irony they conjure—will motivate the changes necessary to clean up our act,” Brownell concluded.

Read the court decisionRead the full story...Reprinted courtesy of

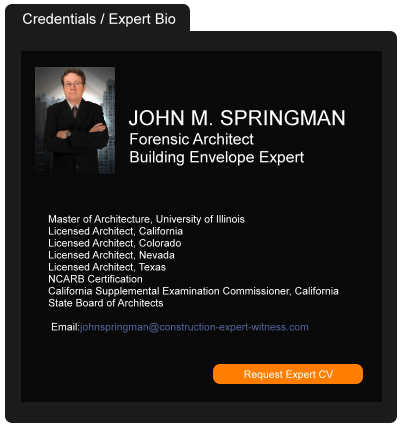

Only Two Weeks Until BHA’s Texas MCLE Seminar in San Antonio

April 28, 2014 —

Beverley BevenFlorez-CDJ STAFFThere are just two weeks remaining to sign up for Bert L. Howe & Associate’s inaugural Texas MCLE seminar, “THE RESIDENTIAL CONSTRUCTION PROCESS & CONSTRUCTION DEFECT LITIGATION.” This activity will be presented on Friday, May 9th at noon in BHA’s San Antonio offices, located at 17806 IH 10, Suite 300, San Antonio, TX 78256. There is no cost for attendance at this seminar and lunch will be provided.

This course has been approved for Minimum Continuing Legal Education credit by the State Bar of Texas Committee on MCLE in the amount of 1.0 credit hours, of which 0.0 credit hours will apply to legal ethics/professional responsibility credit. The seminar will be presented by Don MacGregor, general contractor and project manager.

Water intrusion through doors, windows and roofing systems, as well as soil and foundation-related movement, and the resultant damage associated therewith, are the triggering effects for the vast majority of homeowner complaints today and serve as the basis for most residential construction defect litigation. The graphic and animation-supported workshop/lecture activity will focus on the residential construction process from site preparation through occupancy, an examination of associated damages most often encountered when investigating construction defect claims, and the inter-relationships between the developer, general contractor, sub trades and design professionals. Typical plaintiff homeowner/HOA expert allegations will be examined in connection with those building components most frequently associated with construction defect and claims litigation.

The workshop will examine:

* Typical construction materials, and terminology associated with residential construction

* The installation process and sequencing of major construction elements, including interrelationship with other building assemblies

* The parties (subcontractors) typically associated with major construction assemblies and components

* An analysis of exposure/allocation to responsible parties.

Attendance at THE RESIDENTIAL CONSTRUCTION PROCESS & CONSTRUCTION DEFECT LITIGATION seminar will provide the attendee with:

* A greater understanding of the terms and conditions encountered when dealing with common construction defect issues

* A greater understanding of contractual scopes of work encountered when reviewing construction contract documents

* The ability to identify, both quickly and accurately, potentially responsible parties

* An understanding of damages most often associated with construction defects, as well as a greater ability to identify conditions triggering coverage

Course #: 901290467 / Sponsor #: 14152.

To register for the event, please email Don MacGregor at dmac@berthowe.com. If you have any questions, please feel free to contact Don at (210) 540-9017 (office) or (714) 713-4956 (cell).

Read the court decisionRead the full story...Reprinted courtesy of

Grenfell Fire Probe Faults Construction Industry Practices

November 28, 2022 —

Peter Reina - Engineering News-Record"Incompetence and poor practices in the construction industry" and among others led to the June 2017 fire at London's Grenfell residential high-rise building, causing 72 deaths, according to the lead counsel for the public inquiry that ended Nov. 10.

Reprinted courtesy of

Peter Reina, Engineering News-Record

Mr. Reina may be contacted at reina@btinternet.com

Read the full story... Read the court decisionRead the full story...Reprinted courtesy of

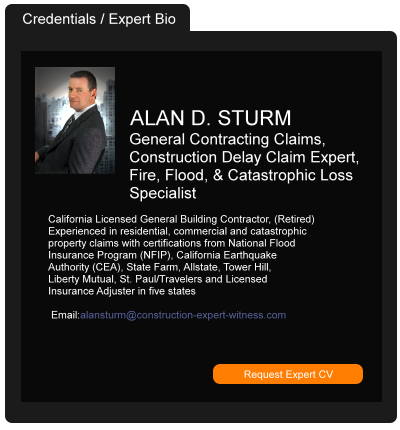

Not so Fast! How Does Revoking Acceleration of a Note Impact the Statute of Limitations?

July 30, 2018 —

Ben Reeves - Snell & Wilmer Real Estate Litigation BlogIntroduction

Lenders routinely accelerate notes after a default occurs, calling the entire loan due immediately. Less regularly, a lender may change its mind and unilaterally revoke the acceleration. Rarely, however, does a lender fail to foreclose on its real property collateral before the statute of limitations expires. In Andra R. Miller Designs, LLC v. U.S. Bank, N.A., 244 Ariz. 265, 418 P.3d 1038 (Ct. App. 2018), a unique set of facts involving these issues led the Arizona Court of Appeals to hold that proper revocation of acceleration resets the statute of limitations.

The Facts

In Miller, a lender made a $1,940,000 loan evidenced by a promissory note and secured by a deed of trust against a home in Paradise Valley, Arizona. The borrower defaulted in September 2008. The default prompted the lender to notice a default, accelerate the note, and initiate a trustee’s sale of the home in 2009. After the lender accelerated the note, the six year statute of limitations began to run. See A.R.S. § 12-548(A)(1) and A.R.S. § 33-816. Pretty standard facts so far, right? Don’t worry, it gets a bit more convoluted.

Read the court decisionRead the full story...Reprinted courtesy of

Ben Reeves, Snell & WilmerMr. Reeves may be contacted at

breeves@swlaw.com