99-Year-Old Transmission Tower Seen as Possible Cause of Devastating Calif. Wildfire

December 11, 2018 —

Contra Costa Times - Engineering News-RecordDec. 08 --PULGA -- With winds gusting around 50 mph in the morning hours of Nov. 8 , portions of a PG&E steel lattice transmission tower -- exposed to the elements high on a ridgetop and originally built when Woodrow Wilson was president -- failed.

As high-voltage lines got loose and whipped around, striking the metal tower, molten aluminum and metal sprayed across tinder dry vegetation, igniting the brush. Arriving firefighters could only watch as the blaze underneath the power lines quickly spread to wild timber and brush.

Read the court decisionRead the full story...Reprinted courtesy of

Engineering News-RecordENR may be contacted at

ENR.com@bnpmedia.com

No Global MDL for COVID Business Interruption Claims, but Panel Will Consider Separate Consolidated Proceedings for Lloyds, Cincinnati, Hartford, Society

August 24, 2020 —

Eric B. Hermanson & Konrad R. Krebs - White and WilliamsIn a widely anticipated ruling, the Judicial Panel on Multidistrict Litigation has denied two motions to centralize pretrial proceedings in hundreds of federal cases seeking coverage for business interruption losses caused by the COVID-19 pandemic. However, the Panel has ordered expedited briefing on whether four separate consolidated proceedings should be set up for four insurers – Cincinnati, Society, Hartford, and Lloyds – who appear to be named in the largest number of claims.

In seeking a single, industry-wide MDL proceeding, some plaintiffs had argued that common questions predominated across the hundreds of pending federal suits: namely, [1] the question of what constituted ‘physical loss or damage’ to property, under the allegedly standardized terms of various insurers’ policies; [2] the question whether various government closure orders should trigger coverage under those policies, and [3] the question whether any exclusions, particularly virus exclusions, applied.

Reprinted courtesy of

Eric B. Hermanson, White and Williams and

Konrad R. Krebs, White and Williams

Mr. Hermanson may be contacted at hermansone@whiteandwilliams.com

Mr. Krebs may be contacted at krebsk@whiteandwilliams.com

Read the court decisionRead the full story...Reprinted courtesy of

Michigan Claims Engineers’ Errors Prolonged Corrosion

June 30, 2016 —

Richard Korman & Erin Richey – Engineering News-RecordOnly a few months ago, Michigan’s state agencies stood at the center of a circle of blame for the Flint water crisis. A special advisory task force had condemned the state’s use of an emergency manager to make key decisions about the city, including, in 2014, the money-saving switch of the water source from Lake Huron to the Flint River and the state Dept. of Environmental Quality’s slow response to citizen reports of smelly, discolored water. On June 22, Michigan Attorney General Bill Schuette started working to expand the circle via a new lawsuit in a Genesee County state court, accusing engineers Veolia N.A. and Houston-based Lockwood, Andrews & Newnam (LAN) and its parent company, Leo A Daly Co., of professional negligence.

Reprinted courtesy of

Richard Korman, Engineering News-Record and

Erin Richey, Engineering News-Record

Mr. Korman may be contacted at kormanr@enr.com

Read the court decisionRead the full story...Reprinted courtesy of

Mexico’s Construction Industry Posts First Expansion Since 2012

August 13, 2014 —

Brendan Case – BloombergMexico’s construction industry expanded in June for the first time in 19 months, adding to signs that the economy is rebounding after missing analyst estimates in seven of the last eight quarters.

Construction increased 2.2 percent from the year earlier, helping industrial production to expand 2 percent, according to data released today by the national statistics agency. The median estimate of 19 economists surveyed by Bloomberg was for industrial output to rise 2.1 percent.

“Industrial activity continued strengthening in June, very much in line with what the market expected,” Mario Correa, the chief Mexico economist at Bank of Nova Scotia, said in a note to clients today. “The construction industry finally showed a positive growth rate.”

Read the court decisionRead the full story...Reprinted courtesy of

Brendan Case, BloombergMr. Case may be contacted at

bcase4@bloomberg.net

Leveraging the 50-State Initiative, Connecticut and Maine Team Secure Full Dismissal of Coverage Claim for Catastrophic Property Loss

March 23, 2020 —

Regen O'Malley - Gordon & Rees Insurance Coverage Law BlogOn behalf of Gordon & Rees’ surplus lines insurer client, Hartford insurance coverage attorneys Dennis Brown, Joseph Blyskal, and Regen O’Malley, with the assistance of associates Kelcie Reid, Alexandria McFarlane, and Justyn Stokely, and Maine counsel Lauren Thomas, secured a full dismissal of a $15 million commercial property loss claim before the Maine Business and Consumer Court on January 23, 2020. The insured, a wood pellet manufacturer, sustained catastrophic fire loss to its plant in 2018 – just one day after its surplus lines policy expired.

Following the insurer’s declination of coverage for the loss, the wood pellet manufacturer brought suit against both its agent, claiming it had failed to timely secure property coverage, as well as the insurer, alleging that it had had failed to comply with Maine’s statutory notice requirements. The surplus lines insurer agreed to extend the prior policy several times by endorsement, but declined to do so again. Notably, the insured alleged that the agent received written notice of the non-renewal prior to the policy’s expiration 13 days before the policy’s expiration. However, the insured (as well as the agent by way of a cross-claim) asserted that the policy remained effective at the time of the loss as the insured did not receive direct notice of the decision not to renew coverage and notice to the agent was not timely. Although Maine’s Attorney General and Superintendent intervened in support of the insured’s and agent’s argument that the statute’s notice provision applied such that coverage would still be owed under the expired policy, Gordon & Rees convinced the Court otherwise.

At issue, specifically, was whether the alleged violation of the 14-day notice provision in Section 2009-A of the Surplus Lines Law (24-A M.R.S. § 2009-A), which governs the “cancellation and nonrenewal” of surplus lines policies, required coverage notwithstanding the expiration of the policy. The insured, the agent, and the State of Maine intervenors argued that “cancellation or nonrenewal” was sufficient to trigger the statute’s notice requirement, and thus Section 2009-A required the insurer to notify the insured directly of nonrenewal. In its motion to dismiss, Gordon & Rees argued on behalf of its client that Section 2009-A requires both “cancellation and nonrenewal” in order for the statute to apply. Since there was no cancellation in this case – only nonrenewal – Gordon & Rees argued that Section 2009-A is inapt and that the insurer is not obligated to provide the manufacturer with notice of nonrenewal. Alternatively, it argued that the statute is unconstitutionally vague and unenforceable.

Read the court decisionRead the full story...Reprinted courtesy of

Regen O'Malley, Gordon & ReesMs. O'Malley may be contacted at

romalley@grsm.com

A Relatively Small Exception to Fraud and Contract Don’t Mix

April 01, 2015 —

Christopher G. Hill – Construction Law MusingsRemember all of my posts about how fraud and contract claims don’t usually play well in litigation? Well, as always with the law, there are exceptions. For instance, a well plead Virginia Consumer Protection Act claim will survive a dismissal challenge.

A recent opinion out of the Alexandria division of the U. S. District Court for the Eastern District of Virginia sets out another exception, namely so called fraudulent inducement. In XL Specialty Ins. Co. v. Truland et al, the Court considered the question of whether both a tort and contract claim can coexist in the same lawsuit when the tort claim is based upon the information provided to the plaintiff when that information proves false.

As the courts of Virginia have held for years, only certain information and statements made pre-contract can be the basis for a fraud claim in the face of a contractual duty to perform. One type of statement that is not properly the subject of a fraud in the inducement type claim is sales talk or opinion. Such sales talk (for example claiming that your company is the best for the job) is not the subject of a fraud claim because it is not meant to be relied upon and that such talk is an opinion about future performance, not a false statement of present fact or intent.

Read the court decisionRead the full story...Reprinted courtesy of

Christopher G. Hill, Law Office of Christopher G. Hill, PCMr. Hill may be contacted at

chrisghill@constructionlawva.com

Couple Claims Contractor’s Work Is Defective and Incomplete

December 04, 2013 —

CDJ STAFFWilliam and Prudence Dziatkowicz have sued Vince Bruno Construction, LLC over a house they contracted to have built in Weirton, West Virginia. According to the Dziatkowiczes, they contracted with Mr. Bruno and his self-named company to build a house, for which they would pay $248,250. The couple claims that Vince Bruno construction never completed work on the house, eventually abandoning the project. Further, they allege that the work done is defective, including improper installation of floor beams, and a failure to properly protect the project from weather.

Additionally, the couple contends that the contractor failed to pay a lumber company, leading to a lawsuit against the Dziatkowiczes and a lien on their house. The Dziatkowiczes are suing Vince Bruno Construction for more than $355,000 in damages.

Read the court decisionRead the full story...Reprinted courtesy of

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

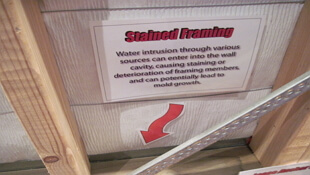

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of