NJ Supreme Court Declines to Review Decision that Exxon Has No Duty to Indemnify Insurers for Environmental Liability Under Prior Settlement Agreement

November 29, 2021 —

Patricia B. Santelle & Laura Rossi - White and WilliamsOn November 1, 2021, in a single-sentence Order, the Supreme Court of New Jersey denied a request for review of a decision that ExxonMobil Corporation (Exxon) did not have to indemnify certain of its insurers over environmental liabilities as required by a previous settlement agreement. The case, entitled Home Insurance Company v. Cornell-Dubilier Electronics Incorporated, et al., has a unique and convoluted procedural history but, in short, the denial of review leaves standing a holding by the intermediate appellate court that the insurers’ “untimely notice actually prejudiced Exxon, violated the no-prejudice rule, and breached the covenant of good faith and fair dealing.” The court declined to consider the question framed by the insurers: whether the importance of enforcing settlement agreements outweighs New Jersey’s entire controversy doctrine.

The matter dated back almost thirty years, when the New Jersey Department of Environmental Protection notified the Appearing London Market Insurers (ALMI) of the potential liability of Cornell-Dublier Electronics (CDE), a former indirect subsidiary of Exxon, for pollution at a site in New Jersey. Coverage litigation followed in New Jersey, which ALMI defended under policies issued to CDE. Exxon was not named in the CDE suit nor were the policies which ALMI issued to Exxon at issue in that case; Exxon instead had its own pollution coverage case pending in New York. In June 2000, Exxon and its insurers, including ALMI, entered into a settlement agreement which (a) required Exxon to indemnify the insurers for any environmental liability claims involving its subsidiaries, and (b) provided for application of New York substantive law and litigation in New York City court for any dispute between the parties under it.

Reprinted courtesy of

Patricia B. Santelle, White and Williams and

Laura Rossi, White and Williams

Ms. Santelle may be contacted at santellep@whiteandwilliams.com

Ms. Rossi may be contacted at rossil@whiteandwilliams.com

Read the court decisionRead the full story...Reprinted courtesy of

“I Didn’t Sign That!” – Applicability of Waivers of Subrogation to Non-Signatory Third Parties

September 30, 2019 —

Rahul Gogineni - The Subrogation StrategistIn Gables Construction v. Red Coats, 2019 Md. App. LEXIS 419, Maryland’s Court of Special Appeals considered whether a contractual waiver of subrogation in the prime contract for a construction project barred a third party – a fire watch vendor hired to guard the worksite – from pursuing a contribution claim against the general contractor. The court concluded that the general contractor could not rely on the waiver of subrogation clause to defeat the contribution claim of the vendor, who was not a party to the prime contract. As noted by the court, holding that a waiver of subrogation clause bars the contribution claims of an entity that was not a party to the contract would violate the intent of the Maryland Uniform Contribution Among Tortfeasors Act (UCATA).

When dealing with claims involving construction projects, there may exist multiple contracts between various parties that contain waivers of subrogation. The enforceability of such waivers can be limited by several factors, including the jurisdiction of the loss, the language of the waiver and the parties to the contract.

In Gables Construction, Upper Rock, Inc. (Upper Rock), the owner, contracted with a general contractor, Gables Construction (GCI) (hereinafter referred to as the “prime contract”), to construct an apartment complex. After someone stole a bobcat tractor from the jobsite, Gables Residential Services Incorporated (GRSI), GCI’s parent company, signed a vendor services agreement (VSA) with Red Coats to provide a fire watch and other security services for the project.

Read the court decisionRead the full story...Reprinted courtesy of

Rahul Gogineni, White and Williams LLPMr. Gogineni may be contacted at

goginenir@whiteandwilliams.com

Recent Statutory Changes Cap Retainage on Applicable Construction Projects

March 11, 2024 —

Patrick McKnight - The Dispute ResolverRecent reforms to certain state retainage laws have reduced the lawful amount of withholding permitted on construction projects. In theory, retainage allows an owner to mitigate the risk of incomplete or defective work by withholding a certain portion of payment until the construction project is substantially complete. Recent statutory developments in Washington, New York, and Georgia represent significant changes in how much an owner may retain on applicable construction projects in those jurisdictions. The details of each state’s retainage laws vary in many important respects. Most states set caps at 5% or 10%, with important variations depending on the type of project and the amount of progress completed. Some states require retainage to be held in an escrow account, but most do not. Many federal construction projects allow up to 10% retainage, while other federal agencies do not require any retention. See 48 CFR § 52.232-5(e) - Payments Under Fixed-Price Construction Contracts.

The ongoing motivation for retainage reform is typically framed in terms of reducing delays in getting payment to subcontractors who complete their scope of work on time and free from defects.

Read the court decisionRead the full story...Reprinted courtesy of

Patrick McKnight, Fox Rothschild LLPMr. McKnight may be contacted at

pmcknight@foxrothschild.com

Insurer Must Pay Portions of Arbitration Award Related to Faulty Workmanship

October 21, 2019 —

Tred R. Eyerly - Insurance Law HawaiiThe court determined that portions of an arbitration award against the insured contractor based upon faulty workmanship were covered by the policy. Wallace v. Nautilus Ins. Co., 2019 U.S. Dist. LEXIS 122219 (D. N. H. July 23, 2010).

Plaintiffs, owners of adjoining homes, hired McPhail Roofing, LLC to replace the roofs of their houses. After installation, the plaintiffs found several problems with their roofs and withheld roughly a third of the agreed-upon contract price from final payments due to McPhail. A roofing consultant found evidence of water leaking through both roofs during rainstorms. Improper installation of the shakes on the roofs allowed rain to seep through to the roof decks (the plywood underneath the roofs) and eventually into the houses. The only way to cure the installation defects was to remove and replace the roofs entirely.

Plaintiffs and McPhail went to arbitration. Plaintiffs sought compensation for the damage caused by the leaking and for the replacement costs of the roofs. McPhail sought the remaining payment under the contracts. Nautilus defended McPhail under this CGL policy.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Damon Key Leong Kupchak HastertMr. Eyerly may be contacted at

te@hawaiilawyer.com

Unlicensed Contractor Shoots for the Stars . . . Sputters on Takeoff

September 20, 2017 —

Garret Murai - California Construction Law BlogElon Musk . . .

Eccentric engineer.

Technology billionaire.

And, now, litigation bad ass.

Frequent readers of the California Construction Law Blog know that we’ve talked about the importance of being properly licensed when doing construction work and the risks to you if you don’t.

One California contractor recently found this out the hard way.

In Phoenix Mechanical Pipeline, Inc. v. Space Exploration Technologies Corp., California Court of Appeals for the Second District, Case No. B269186 (June 13, 2017), contractor Phoenix Mechanical Pipeline, Inc. (Phoenix) lost its boosters . . . err britches . . when it sued Elon Musk’s Space Exploration Technologies Corp. (Space X) due to its failure to have a California contractor’s license.

Read the court decisionRead the full story...Reprinted courtesy of

Garret Murai, Wendel Rosen Black & Dean LLPMr. Murai may be contacted at

gmurai@wendel.com

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

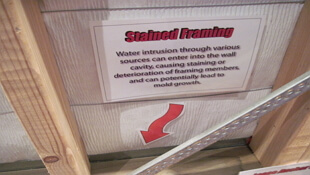

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

Cybersecurity “Flash” Warning for Construction and Manufacturing Businesses

April 05, 2021 —

Jeffrey M. Dennis - Newmeyer DillionOn March 23, 2021, the FBI’s Cyber Division issued a “Flash” warning for several business sectors, including industrial, commercial, manufacturing and construction businesses. The FBI is warning that a strain of ransomware, known as “Mamba,” has been used to weaponize a widely-used encryption software known as DiskCryptor. Mamba works through the open-source DiskCryptor program to encrypt a company’s operating system and demand ransom payment. This new ransomware attack is a threat to any business which employs DiskCryptor, specifically manufacturing and construction companies.

What Should I Do?

If your company utilizes DiskCryptor, the FBI suggests a number of recommendations to mitigate and ward off any ransomware attack. Most of these suggestions fall within the guidelines of proper cyber hygiene, and include (but are not limited to) the following:

- Regularly back up data, as well as copies of data;

- Segment your network;

- Request administrator credentials to install software;

Read the court decisionRead the full story...Reprinted courtesy of

Jeffrey M. Dennis, Newmeyer DillionMr. Dennis may be contacted at

jeff.dennis@ndlf.com

Denver’s Proposed Solution to the Affordable Housing Crisis

March 06, 2022 —

Taylor Ostrowski - Colorado Construction Litigation BlogOver the past ten years, Colorado has seen a population growth of almost 15 percent, with many residing in Denver. In fact, in 2020, Denver ranked among the top five cities for inbound growth in the United States. At the same time, from 2010 through 2020, the state’s production of new housing decreased by 40 percent. The decrease in supply, coupled with the increase in demand has exasperated the already rising cost of housing in the state. This, along with other external factors such as job loss due to the COVID pandemic, has resulted in a statewide housing crisis.

The City of Denver is proposing a revision to the municipal code that would expand affordable housing through three main tools: (1) increasing “linkage fees,” (2) requiring new multi-family development to designate a percentage of units to be affordable, and (3) offering zoning and financial incentives. The proposal addresses both rental housing and ownership opportunities. Although it is essential to combat the housing crisis and increased homelessness in the region, it is equally important to understand the impacts the proposed affordable housing ordinance would have on developers, if and when enacted.

Read the court decisionRead the full story...Reprinted courtesy of

Taylor Ostrowski, Higgins, Hopkins, McLain & Roswell, LLCMs. Ostrowski may be contacted at

ostrowski@hhmrlaw.com