Intricacies of Business Interruption Claim Considered

January 07, 2015 —

Tred R. Eyerly – Insurance Law HawaiiReaching into the weeds to analyze a business interruption claim, the Massachusetts Court of Appeals determined the cost of ordinary payroll could be included in the calculation of net profit or loss in determining business loss income when business is resumed quickly after a fire. Verrill Farms, LLC v. Farm Family Cas. Ins. Co., 2014 Mass. App. LEXIS 145 (Mass. App. Ct. Nov. 4, 2014).

The insured suffered a fire loss at its farm store. Within two days, the business was reopened at alternate locations at reduced capacity. Within a month, the business had resumed nearly full capacity in temporary locations. No employees were laid off. This allowed the insured to maintain its business and generate income.

The insured submitted a claim for loss of business income, based on its loss of net income in the year after the fire. The insurer paid a sum considerably less than the claim based upon its interpretation of what expenses could be included in a calculation of net profit or loss in order to determine loss of business income. The trial court held that the insurer did not have to pay the cost of ordinary payroll beyond the sixty-day limit, and granted summary judgment in the insurer's favor.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com

California Bid Protests: Responsiveness and Materiality

January 06, 2016 —

Garret Murai – California Construction Law BlogIt can be a rough and tumble world out there. And in the case of public works construction in California, this includes bid disputes.

California’s competitive bidding laws require that a public works contract be awarded to the “lowest responsible bidder.” However, as we’ve mentioned before, there are two requirements which must be satisfied for a bidder to be determined to be the lowest responsible bidder: (1) the awarded bidder’s bid must be “responsive”; and (2) the awarded bidder must be “responsible.”

In a case decided this past month, DeSilva Gates Construction v. Department of Transportation, Case No. C074521 (December 14, 2015), the California Court of Appeals for the Third District addressed the first of these two requirements, whether two bids on $34 million highway widening project were responsive, which in turn involves a two-step process: (1) whether the bids were responsive or not; and (2) if not, whether the variance in the bids were “material” or “immaterial.”

Read the court decisionRead the full story...Reprinted courtesy of

Garret Murai, Wendel Rosen Black & Dean LLPMr. Murai may be contacted at

gmurai@wendel.com

Court Addresses When Duty to Defend Ends

August 24, 2020 —

Anthony L. Miscioscia & Margo E. Meta - White and WilliamsThere are certain generally held principles regarding an insurer’s duty to defend. One of these principles is that an insurer has a duty to defend its insured if the complaint states a claim that potentially falls within the policy’s coverage. However, there is a lack of consistency regarding the point at which the insurers’ duty to defend ends. When the only potentially covered claim has been dismissed, must the insurer continue to defend?

Certain jurisdictions, such as Hawaii and Minnesota, have held that an insurer’s duty to defend continues through an appeals process, or until a final judgment has been entered, disposing of the entire case. Commerce & Industry Insurance Company v. Bank of Hawaii, 832 P.2d 733 (Haw. 1992); Meadowbrook, Inc. v. Tower Insurance Company, 559 N.W. 2d 411 (Minn. 1997).

Earlier this week, the U.S. District Court for the Eastern District of Pennsylvania took a different approach to this question in Westminster American Insurance Company v. Spruce 1530, No. 19-539, 2020 U.S. Dist. LEXIS 106534 (E.D. Pa. June 17, 2020) – holding that the trial court’s dismissal of the only potentially covered claim was sufficient to terminate Westminster’s duty to defend.

Reprinted courtesy of

Anthony L. Miscioscia, White and Williams and

Margo E. Meta, White and Williams

Mr. Miscioscia may be contacted at misciosciaa@whiteandwilliams.com

Ms. Meta may be contacted at metam@whiteandwilliams.com

Read the court decisionRead the full story...Reprinted courtesy of

Texas Supreme Court Finds Payment of Appraisal Award Does Not Absolve Insurer of Statutory Liability

April 19, 2021 —

Allison Griswold & Sarah Smith - Lewis BrisboisThe Texas Supreme Court recently published its long-awaited decision in the Hinojos v. State Farm Lloyds. In it, the court affirmed its holding in Barbara Technologies, finding that payment of an appraisal award does not absolve an insurer of statutory liability when the insurer accepts a claim but pays only part of the amount it owes within the statutory deadline, and a policy holder can proceed with an action under the Texas Prompt Payment of Claims Act.

In 2013, Louis Hinojos made a claim for storm damage to his home. State Farm’s initial inspection resulted in an estimate below the deductible, but Hinojos disagreed and requested a second inspection. At the second inspection, the adjuster identified additional damage resulting in a payment to Hinojos of $1,995.11. Hinojos then sued State Farm – and State Farm invoked appraisal approximately 15 months after suit was filed. The appraisal resulted in State Farm tendering an additional payment of $22,974.75. State Farm moved for summary judgment, arguing that timely payment of an appraisal award precluded prompt payment (or Chapter 542) damages. The trial court granted summary judgment and Hinojos appealed (notably Barbara Technologies had not yet been decided). The Court of Appeals affirmed State Farm’s victory on the basis that “State Farm made a reasonable payment on Hinojos’s claim within the sixty-day statutory limit….” Hinojos petitioned the Texas Supreme Court for review.

Reprinted courtesy of

Allison Griswold, Lewis Brisbois and

Sarah Smith, Lewis Brisbois

Ms. Griswold may be contacted at Allison.Griswold@lewisbrisbois.com

Ms. Smith may be contacted at Sarah.Smith@lewisbrisbois.com

Read the court decisionRead the full story...Reprinted courtesy of

Couple Claims Poor Installation of Home Caused Defects

December 30, 2013 —

CDJ STAFFRobert and Tracy Samosky of Spanishburg, West Virginia have filed a lawsuit claiming that the improper delivery of their modular home caused defects and damages, preventing them from actually using their home. The couple purchased a modular home from J&M Quality Construction for a home designed and built by Mod-U-Kraf Homes. They are suing the two firms for $50,000 in damages, reports the West Virginia Record.

Read the court decisionRead the full story...Reprinted courtesy of

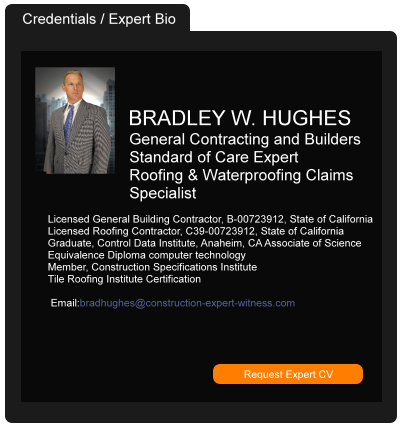

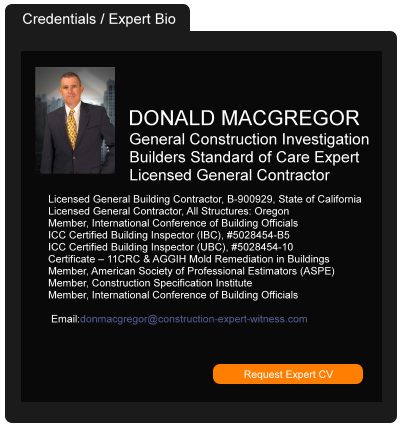

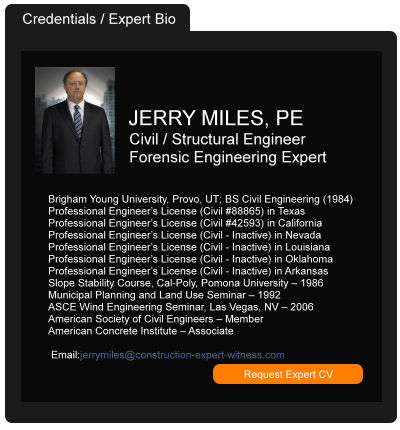

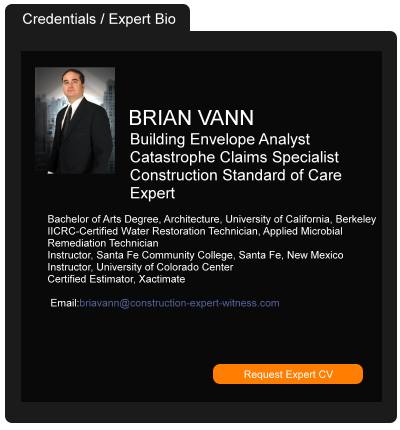

BHA Expands Construction Experts Group

October 28, 2011 —

Bert L. Howe & Associates, Inc. - Corporate OfficesBert L. Howe & Associates, Inc., one of the nation’s leading construction forensics firms is pleased to announce the expansion of the company’s civil and structural engineering capabilities.

JERRY M. MILES, PE - Mr. Miles has been a licensed civil engineer in California since 1987 and has served as the lead civil engineer on many projects in several states. His experience includes contract administration services as the owner’s representative on a variety of projects including mastered planned communities, residential subdivisions, shopping centers and multi-family residential projects. He has also been involved in providing water quality management plans and storm water pollution prevention plans. Mr. Miles has also served on the Town of Apple Valley’s Building Department Dispute Resolution Board.

His more than 26 years of engineering experience includes geotechnical evaluations, structural design of wood-framed, masonry, and concrete tilt-up buildings, small and large subdivision engineering construction/improvements plans, hydrology/hydraulic reports and design, forensic investigation and expert witness testimony. Mr. Miles has qualified as an expert in numerous jurisdictions and Federal court. He has been called upon to provide deposition testimony on more than twenty-five occasions and has successfully testified at arbitration and trial. Click here to view Mr. Miles’ Current CV.

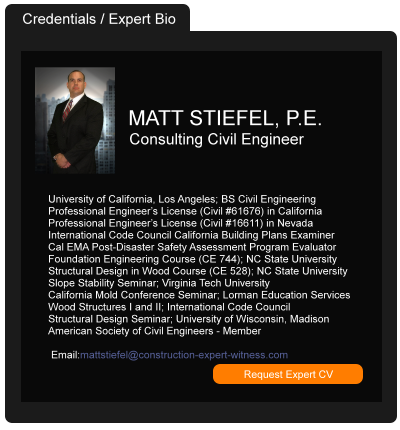

MATTHEW J. STIEFEL, PE - With a background that spans a multitude of design and new construction projects to catastrophic claims analysis, Mr. Stiefel brings a unique set of credentials and experience to the construction experts group at Bert L. Howe & Associates. Mr. Stiefel has more than 13 years’ experience in civil, structural, and geotechnical engineering; providing design and construction consulting services on a variety of projects that include multi-family and single family dwellings, commercial buildings, transportation facilities, industrial facilities, storm drain channels, water and wastewater pipelines. His engineering experience encompasses multiple disciplines of civil engineering including geotechnical design and evaluation, foundation design, structural design of wood-framed buildings, preparation of grading plans and site drainage analysis. He has provided cause and origin analysis for insurance adjusters on many residential and commercial sites related to issues involving moisture intrusion and mold, foundation movement, site drainage, soil movement, wind damage, and other various losses. Click here to view Mr. Stiefel’s Current CV.

Read the court decisionRead the full story...Reprinted courtesy of

Damage to Plaintiffs' Home Caused By Unmoored Boats Survives Surface Water Exclusion

April 06, 2016 —

Tred R. Eyerly – Insurance Law HawaiiThe magistrate's recommended decision found that damage to plaintiffs' home caused by boats that became loose during Hurricane Sandy was not barred as "water borne material" under the surface water exclusion. Spindler v. Great N. Ins. Co., 2016 U.S. Dist. LEXIS 16532 (E.D. N. Y. Feb. 2, 2016).

Plaintiffs' home abutted the East Bay. The property had an exterior deck and a long dock that floated on the bay. Hurricane Sandy damaged plaintiffs' home and dock. A neighbor witnessed two boats, driven by the storm, repeatedly strike plaintiffs' dock, house, and deck. There was no dispute that water infiltrated plaintiffs' yard prior to the entry of the boats. Plaintiffs spent $286,280 to repair damaged items from the storm.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Insurance Law HawaiiMr. Eyerly may be contacted at

te@hawaiilawyer.com

Real Estate & Construction News Roundup (1/24/24) – Long-Term Housing Issues in Hawaii, Underperforming REITs, and Growth in a Subset of the Hotel Sector

February 19, 2024 —

Pillsbury's Construction & Real Estate Law Team - Gravel2Gavel Construction & Real Estate Law BlogIn our latest roundup, commercial real estate’s relationship with technology, towns and cities across the country prevent dollar stores from opening, empty offices and other commercial buildings are reused for housing, and more!

Read the court decisionRead the full story...Reprinted courtesy of

Pillsbury's Construction & Real Estate Law Team