Crime Policy Insurance Quotes Falsely Represented the Scope of its Coverage

July 13, 2020 —

Brian J Clifford - Saxe Doernberger & VitaAn Indiana businessman found out the hard way how far his insurance company was willing to go to avoid paying a claim after it misrepresented the coverage of a crime policy it sold to him. The quote for the policy indicated that it included coverage for losses resulting from computer hacking. Despite this representation, when the policyholder’s bank accounts were hacked, the insurer denied coverage on the ground that there was no provision for hacking coverage in the policy. Fortunately, the Indiana Court of Appeals recognized the insured’s right to argue before a jury that the insurer’s quotes falsely represented the scope of its coverage.

In Metal Pro Roofing, LLC v. Cincinnati Ins. Co., Richard Cornett, principal of Metal Pro Roofing, LLC and Cornett Restoration, LLC (the “LLCs”), purchased a Cincinnati Insurance Company CinciPlus Crime XC+ Policy (the “Policy”). At the time Mr. Cornett purchased this coverage, and during all subsequent renewals, Cincinnati issued insurance quotes that stated:

Cincinnati can insure your money and securities while at your premises, inside your bank and even off site in the custody of a courier. While you’ve taken precautions to protect your money and securities, you run the risk of loss from employees, robbers, burglars, computer hackers and even physical perils such as fire.

Give yourself peace of mind with Cincinnati’s crime coverage to insure the money and securities you worked so hard to earn.

Crime Expanded Coverage (XC®)Plus Endorsement $125.00.

(Emphasis added.)

Read the court decisionRead the full story...Reprinted courtesy of

Brian J Clifford, Saxe Doernberger & VitaMr. Clifford may be contacted at

bjc@sdvlaw.com

Insurer Able to Refuse Coverage for Failed Retaining Wall

October 28, 2011 —

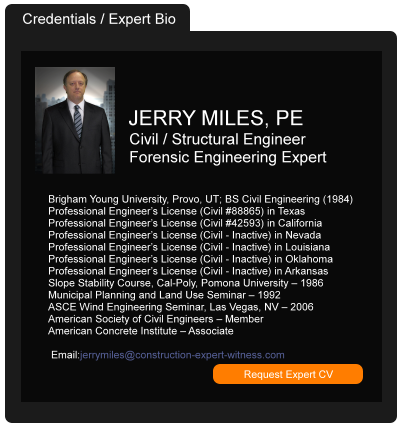

CDJ STAFFThe Eleventh District of the US Court of Appeals has ruled in the case of Nix v. State Farm Fire & Casualty Company. In this case, the Nixes filed a claim after a portion of the retaining wall in their home collapsed and their basement flooded. State Farm denied the claim “on the ground that the policy excluded coverage for collapses caused by defects in construction and for damage caused by groundwater.”

The court reviewed the Nixes’ policy and found that State Farm’s statement did specifically exclude both of these items. In reviewing the lower court’s ruling, the appeals court noted that State Farm’s expert witness, Mark Voll, determined that the retaining wall “lacked reinforcing steel, as required by a local building code, and could not withstand the pressure created by groundwater that had accumulated during a heavy rainfall.” Additionally, a french drain had been covered with clay soil and so had failed to disperse the groundwater.

The Nixes argued that the flooding was due to a main line water pipe, but their opinions were those of Terry Nix and the contractor who made temporary repairs to the wall. “Those opinions were not admissible as lay testimony. Neither Nix nor the contractor witnessed the wall collapse or had personal knowledge about the construction of the Nixes’ home.”

The lower court granted a summary judgment to State Farm which has been upheld by the appeals court.

Read the court’s decision…

Read the court decisionRead the full story...Reprinted courtesy of

End of an Era: Los Angeles County Superior Court Closes the Personal Injury Hub

October 24, 2022 —

Elizabeth A. Evans & Angela S. Haskins - Haight Brown & Bonesteel LLPOn September 21, 2022, the Los Angeles County Superior Court announced that it would start a gradual shutdown of the Personal Injury Hub, currently located at the Spring Street Courthouse. This closure will see the return of personal injury cases being venued in the district where they occurred.

The Personal Injury Hub was established in 2012 as a means of consolidating personal injury cases after several civil courtrooms around the County were closed due to significant budget cuts. It first began as two courtrooms in Stanley Mosk Superior Court, then moved to the Spring Street Courthouse and ballooned to six courtrooms, each handling a case load of reportedly over 9,000 cases at times. Case Management Conferences were abolished and the parties were largely left to their own devices to move cases along. At times, slow chaos ensued. With a new and increased budget, Los Angeles Superior Court has now decided that enough is enough.

Effective October 10, 2022, new personal injury cases will be filed and handled from start to finish in independent calendar courtrooms in the districts where the events giving rise to the claims occurred. Any cases properly filed in the Central District will continue to be heard in the Personal Injury Hub for now. A new Civil Case Cover Sheet Addendum that reflects this change will be available on the Los Angeles County Superior Court website for use as of October 10th.

Reprinted courtesy of

Elizabeth A. Evans, Haight Brown & Bonesteel LLP and

Angela S. Haskins, Haight Brown & Bonesteel LLP

Ms. Evans may be contacted at eevans@hbblaw.com

Ms. Haskins may be contacted at ahaskins@hbblaw.com

Read the court decisionRead the full story...Reprinted courtesy of

Colorado’s New Construction Defect Law Takes Effect in September: What You Need to Know

September 07, 2017 —

Jesse Witt - The Witt Law FirmColorado’s new construction defect law officially takes effect this month. Although HB 17-1279 was passed in May, the statutory text provides that it only applies “with respect to events and circumstances occurring on or after September 1, 2017.” With that date now upon us, practitioners should be mindful of the law’s new requirements.

The law applies to any lawsuit wherein a homeowner association files a construction defect action on behalf of two or more of its members. “Construction defect action” is defined broadly to include any claims against construction professionals relating to deficiencies in design or construction of real property. Before an association may commence such an action, its board must follow several steps.

First, the board must deliver notice of the potential construction defect action to all homeowners and the affected construction professionals at their last known addresses. This requirement does not apply to construction professionals identified after the notice has been mailed, or to construction professionals joined in a previously-approved lawsuit. The notice must include a description of the alleged construction defects with reasonable specificity, the relief sought, a good-faith estimate of the benefits and risks involved, and a list of mandatory disclosures concerning assessments, attorney fees, and the marketability of units affected by construction defects. The notice must also call a meeting of all homeowners. The notice should be sent to the construction professionals at least five days before the homeowners.

Reprinted courtesy of

Jesse Howard Witt, Acerbic Witt

Mr. Witt may be contacted at www.witt.law

Read the full story... Read the court decisionRead the full story...Reprinted courtesy of

Wisconsin Supreme Court Holds that Subrogation Waiver Does Not Violate Statute Prohibiting Limitation on Tort Liability in Construction Contracts

October 21, 2019 —

Gus Sara - The Subrogation StrategistIn Rural Mut. Ins. Co. v. Lester Bldgs., LLC 2019 WI 70, 2019 Wisc. LEXIS 272, the Supreme Court of Wisconsin considered whether a subrogation waiver clause in a construction contract between the defendant and the plaintiff’s insured violated Wisconsin statute § 895.447, which prohibits limitations of tort liability in construction contracts. The Supreme Court affirmed the lower court’s decision that the waiver clause did not violate the statute because it merely shifted the responsibility for the payment of damages to the defendant’s insurance company. The waiver clause did not limit or eliminate the defendant’s tort liability. This case establishes that while

§ 895.447 prohibits construction contracts from limiting tort liability, a subrogation waiver clause that merely shifts responsibility for the payment of damages from a tortfeasor to an insurer does not violate the statute and, thus, is enforceable.

In Rural Mutual, the plaintiff’s insured, Jim Herman, Inc. (Herman), entered into a contract with Lester Buildings, LLC (Lester) to design and construct a barn on Herman’s property. The contract included a provision that stated the following:

Both parties waive all rights against each other and any of their respective contractors, subcontractors and suppliers of any tier and any design professional engaged with respect to the Project, for recovery of any damages caused by casualty of other perils to the extent covered by property insurance applicable to the Work or the Project, except such rights as they have to the proceeds of such property insurance and to the extent necessary to recover amounts relating to deductibles of self-insured retentions applicable to insured losses. . . . This waiver of subrogation shall be effective notwithstanding allegations of fault, negligence, or indemnity obligation of any party seeking the benefit or production [sic] of such waiver.

Read the court decisionRead the full story...Reprinted courtesy of

Gus Sara, White and WilliamsMr. Sara may be contacted at

sarag@whiteandwilliams.com

Brown and Caldwell Appoints Stigers as Design Chief Engineer

December 13, 2022 —

Brown and CaldwellWALNUT CREEK, Calif., Dec. 06, 2022 — Brown and Caldwell today announces Vice President Tracy Stigers has been appointed as design chief engineer in recognition of four decades of exceptional technical leadership and client service. She is the first woman in the firm's 75-year history to hold the esteemed title.

Stigers will lead all design from a technical and delivery expertise perspective across all of Brown and Caldwell's design initiatives, implementing innovation, quality control, and project delivery throughout North America and the Pacific.

Since joining the leading environmental engineering and construction services firm in 1980, Stigers has progressed from junior engineer to one of its top technical and delivery experts. She has vast experience in the design and construction of large-scale wastewater conveyance, treatment, and reuse facilities, including serving as project manager on the San Francisco Public Utilities Commission's $2.3 billion Biosolids Digester Facilities Project, the largest value design job in Brown and Caldwell's history.

Early in her career, Stigers worked alongside and was mentored by company co-founder Dave Caldwell, helping shape its tradition of solving the most challenging water and environmental challenges. Her dedication to upholding Brown and Caldwell's reputation for project excellence and innovation was commended by CEO Rich D'Amato:

"Tracy is the epitome of quality, commitment, and technical prowess," he said. "Her leadership, knowledge, and legacy of delivering solutions to clients perfectly embody our heritage and is a shining example for tomorrow's aspiring engineering leaders."

Throughout her career, Stigers has held numerous leadership roles at industry organizations, including sitting on the board of trustees for the Water Environment Federation and the California Water Environment Association. She is a current member of the Clarkson University Engineering Advisory Council.

About Brown and Caldwell

Headquartered in Walnut Creek, California, Brown and Caldwell is a full-service environmental engineering and construction services firm with 52 offices and 1,800 professionals across North America and the Pacific. For 75 years, our creative solutions have helped municipalities, private industry, and government agencies successfully overcome their most challenging water and environmental obstacles. As an employee-owned company, Brown and Caldwell is passionate about exceeding our clients' expectations and making a difference for our employees, our communities, and our environment. For more information, visit www.brownandcaldwell.com

Read the court decisionRead the full story...Reprinted courtesy of

Auburn Woods Homeowners Association v. State Farm General Insurance Company

January 11, 2021 —

Michael Velladao - Lewis BrisboisIn Auburn Woods HOA v. State Farm Gen. Ins. Co., 56 Cal.App.5th 717 (October 28,2020) (certified for partial publication), the California Third District Court of Appeal affirmed the trial court’s entry of judgment in favor of State Farm General Insurance Company (“State Farm”) regarding a lawsuit for breach of contract and bad faith brought by Auburn Woods Homeowners Association (“HOA”) and property manager, Frei Real Estate Services (“FRES”) against State Farm and the HOA’s broker, Frank Lewis. The parties’ dispute arose out of the tender of two different lawsuits filed against the HOA and FRES by Marva Beadle (“Beadle”). The first lawsuit was filed by Beadle as the owner of a condominium unit against the HOA and FRES for declaratory relief, injunctive relief, and an accounting related to amounts allegedly owed by Beadle to the HOA as association fees. The second lawsuit filed by Beadle was for the purpose of setting aside a foreclosure sale, cancelling the trustee’s deed and quieting title, and for an accounting and injunctive relief against an unlawful detainer action filed by Sutter Group, LP against Beadle. The complaint filed in the second lawsuit alleged that Allied Trustee Services caused Beadle’s property to be sold at auction and that Sutter Capital Group, LP purchased the unit and obtained a trustee’s deed upon sale. Beadle claimed the assessments against her were improper and the trustee’s deed upon sale was wrongfully executed. Beadle sought an order restoring possession of her unit and damages.

The HOA and FRES tendered both lawsuits to State Farm. As respects the first lawsuit, State Farm denied coverage of the lawsuit based on the absence of alleged “damages” covered by the policy issued to the HOA affording liability and directors and officers (“D&O”) coverages. State Farm agreed to defend the HOA under the D&O coverage in the second lawsuit. However, State Farm denied coverage of FRES in both lawsuits as it did not qualify as an insured under the State Farm policy issued to the HOA. Subsequently, the HOA and FRES filed an action against State Farm arguing that a duty to defend was triggered under its policy for the first lawsuit and a duty to defend FRES was also owed under the D&O policy for the second lawsuit. After a bench trial, the trial court entered summary judgment in favor of State Farm based on the failure of the first lawsuit to allege damages covered by the State Farm policy under the liability and D&O coverages afforded by the policy. As respects the second lawsuit, the trial court held that FRES did not qualify as an insured and State Farm did not act in bad faith by refusing to pay the HOA’s alleged defense costs in the second lawsuit before it agreed to defend the HOA against such lawsuit.

Read the court decisionRead the full story...Reprinted courtesy of

Michael Velladao, Lewis BrisboisMr. Velladao may be contacted at

Michael.Velladao@lewisbrisbois.com

Federal Judge Vacates CDC Eviction Moratorium Nationwide

May 24, 2021 —

Zachary Kessler, Amanda G. Halter & Adam Weaver - Gravel2Gavel Construction & Real Estate Law BlogLate last week a federal district court judge for the District of Columbia held that the nationwide eviction moratorium issued by the Centers for Disease Control and Prevention (CDC) went beyond the agency’s statutory authority and vacated it nationwide. This decision effectively expanded a similar decision by a Texas federal court last month that found the CDC’s moratorium was an improper use of federal power but limited its decision to the litigants to that case and declined to vacate the CDC order.

The CDC eviction moratorium (the Order) was designed to halt certain cases of eviction for low-income tenants and was the most significant nationwide tenant protection for nonpayment of rent due to the COVID-19 pandemic. While the federal government has said it will appeal this week’s decision and has sought to stay its effect, it is a significant blow to the federal government’s efforts to halt evictions due to the COVID-19 pandemic. This decision may now open an avenue for landlords to begin evicting nonpaying tenants that had been halted by the eviction moratorium since mid-2020.

Reprinted courtesy of

Zachary Kessler, Pillsbury,

Amanda G. Halter, Pillsbury and

Adam Weaver, Pillsbury

Mr. Kessler may be contacted at zachary.kessler@pillsburylaw.com

Ms. Halter may be contacted at amanda.halter@pillsburylaw.com

Mr. Weaver may be contacted at adam.weaver@pillsburylaw.com

Read the court decisionRead the full story...Reprinted courtesy of