Arizona Supreme Court Clarifies Area Variance Standard; Property Owners May Obtain an Area Variance When Special Circumstances Existed at Purchase

October 19, 2017 —

Nick Wood, Adam Lang, Noel Griemsmann, & Brianna Long – Snell & Wilmer Real Estate Litigation BlogIn Pawn 1st v. City of Phoenix, the Arizona Supreme Court rejected a Court of Appeals rule that would have unduly restrained alienation of property in Arizona. The Court of Appeals found that the City of Phoenix Board of Adjustment acted beyond its authority when it granted an area variance to a pawn shop where the special circumstances causing a need for the variance existed before the pawn shop purchased the property. Under Arizona law, boards of adjustment cannot grant an area variance where the special circumstances requiring the variance are self-imposed. The Court of Appeals adopted a rule that knowledge of special circumstances at the time of purchase made the special circumstances self-imposed, foreclosing the purchaser’s ability to obtain a variance. This rule would have severely restricted property purchasers’ ability to obtain area variances in Arizona and by extension likely strained property transactions.

The underlying case involved a pawn shop that was proposed in southeast Phoenix. After the property purchaser obtained approval for a required use permit (for a pawn shop) and a variance (for a 500 foot residential setback) from the City of Phoenix Board of Adjustment, a competing pawn shop filed a special action arguing that the variance was a use variance, not an area variance, beyond the board of adjustment’s authority.

Reprinted courtesy of Snell & Wilmer attorneys

Nick Wood,

Adam Lang,

Noel Griemsmann and

Brianna Long

Mr. Wood may be contacted at nwood@swlaw.com

Mr. Lang may be contacted at alang@swlaw.com

Mr. Noel may be contacted at ngriemsmann@swlaw.com

Ms. Brianna may be contacted at bllong@swlaw.com

Read the court decisionRead the full story...Reprinted courtesy of

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

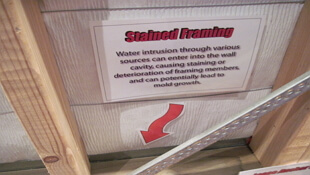

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

Verdict In Favor Of Insured Homeowner Reversed For Improper Jury Instructions

October 23, 2018 —

Tred R. Eyerly - Insurance Law HawaiiThe appellate court reversed the jury verdict in favor of the homeowners based upon improper instructions purporting to impose a duty to adjust the claim and how to construe a contract. Citizens Prop. Ins. Corp. v Mendoza, 2018 Fla. App. LEXIS 9497 (Fla. Ct. App. July 5, 2018).

The insureds incurred water damage to their home caused by a water heater leak. After a claim was filed, the insurer sent an adjuster to investigate the claim. The insurer denied the claim due to an exclusion for constant or repeated seepage or leakage.

At trial, the insurer offered testimony that the leak was a continued and repeated seepage of water over a long period of time, which was excluded under the policy, and not a sudden and accidental discharge of water, which would have been covered.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Damon Key Leong Kupchak HastertMr. Eyerly may be contacted at

te@hawaiilawyer.com

Construction Recovery Still Soft in New Hampshire

May 10, 2013 —

CDJ STAFFThe latest building news out of New Hampshire is somewhat mixed. Yes, there has been an increase of seventeen percent in the value of future residential construction on the state. But that’s not enough to offset the general slide in the value of future construction overall. The New Hampshire Business Review reports that the state saw a four percent drop in the cost of planned construction, comparing March 2012 to March 2013.

The total value of the drop was shared between the twelve percent drop in nonresidential construction and the fifty-two percent drop in infrastructure building, each of which were more than $4 million less than in the prior year. The rise in residential construction could not make up the loss in other areas.

Read the court decisionRead the full story...Reprinted courtesy of

Ohio Court of Appeals: Absolution Pollution Exclusion Bars Coverage for Workplace Coal-Tar Pitch Exposure Claims

January 10, 2018 —

Complex Insurance Coverage ReporterOn December 28, 2017, the Ohio Court of Appeals (Eighth District) held in GrafTech International, Ltd., et al. v. Pacific Employers Ins. Co., et al., No. 105258 that coverage for alleged injurious exposures to coal tar pitch was barred by a liability insurance policy’s absolute pollution exclusion. Applying Ohio law, the court concluded that Pacific Employers had no duty to defend GrafTech or pay defense costs in connection with claims by dozens of workers at Alcoa smelting plants that they were exposed to hazardous substances in GrafTech products supplied to Alcoa as early as 1942.

Read the court decisionRead the full story...Reprinted courtesy of

White and Williams LLP

Elon Musk's Boring Co. Is Feuding With Texas Over a Driveway

July 25, 2022 —

Sarah McBride - BloombergWhile Elon Musk is publicly making a big deal about moving to Texas and cozying up to the governor, behind the scenes his tunnel-building venture, Boring Co., is wrangling with local authorities in the state over a host of seemingly mundane permitting issues.

Since Boring bought land last May to create a research and development center in Bastrop, Texas, a rural area outside Austin, the company has put workers up on mobile homes at the site without authorized sewage facilities, failed to get air and stormwater permits and built a driveway without first getting official approval, according to documents obtained by Bloomberg News through a public records request.

The company’s dealings with Bastrop are yet another illustration of how Musk’s businesses often push the boundaries of or simply ignore regulations that bind other companies. In recent years his Tesla Inc. restarted production at its Fremont plant in defiance of pandemic rules to stay closed, Boring tried to build a tunnel in Los Angeles without going through an environmental review process and the US Securities and Exchange Commission is examining the disclosure of Musk’s stake in Twitter Inc.

Read the court decisionRead the full story...Reprinted courtesy of

Sarah McBride, Bloomberg

Phillips & Jordan Awarded $176M Everglades Restoration Contract

March 01, 2021 —

Thomas F. Armistead - Engineering News-RecordConstruction of the next major project for the Everglades Agricultural Area Reservoir south of Lake Okeechobee is set to begin in April following the South Florida Water Management District's award of a $175.8-million lump-sum contract to Phillips and Jordan Inc.

Reprinted courtesy of

Thomas F. Armistead, Engineering News-Record

ENR may be contacted at ENR.com@bnpmedia.com

Read the full story... Read the court decisionRead the full story...Reprinted courtesy of

Vertical vs. Horizontal Exhaustion – California Supreme Court Issues Ruling Favorable to Policyholders

May 11, 2020 —

Alan Packer & James Hultz - Newmeyer DillionFor years, when faced with damage or injury spanning several policy periods, excess general liability insurers have argued that all potentially applicable underlying policies must be exhausted before the excess drops down to provide coverage (“horizontal exhaustion”). Insureds, on the other hand, insist that they are entitled to immediately access an excess policy for any given policy year, if that year’s underlying policy has exhausted (“vertical exhaustion”). Vertical exhaustion not only enables insureds to directly tap into the excess insurance for which they paid substantial premiums, but also enables the insured to moderate risk given that different lower level policies might (1) be needed for other claims, (2) have larger self-insured retentions, or (3) have other less favorable coverage provisions. Allowing an insured to proceed via vertical exhaustion would also eliminate the heavy administrative and logistical burden that could result from having to pursue and exhaust all underlying coverage on multi-year claims.

In Montrose Chemical Corp. v. Superior Court, 2020 WL 1671560 (April 6, 2020), the California Supreme Court has come down in favor of policyholders and vertical exhaustion. The Montrose case involved contamination that allegedly occurred between 1947 and 1982 and different liability insurance towers (comprised of primary and excess layers) for each year. The insured, Montrose, maintained a tower of insurance coverage, year by year, and faced claims asserting damage that spanned several decades. Montrose sought coverage from excess insurers under a vertical exhaustion approach. Not surprisingly, Montrose’s excess insurers insisted that horizontal exclusion was required and that Montrose was required to exhausted all other policies with lower attachment points in every single involved policy period. The California Supreme Court ruled in Montrose’s favor, holding that the insured may insist upon full coverage from an excess insurer once the layer directly below it has exhausted. The Court reasoned that the burden of spreading the loss among insurers is one that is appropriately borne by insurers, not insureds.

Reprinted courtesy of

Alan H. Packer, Newmeyer Dillion and

James S. Hultz, Newmeyer Dillion

Mr. Packer may be contacted at alan.packer@ndlf.com

Mr. Hultz may be contacted at james.hultz@ndlf.com

Read the court decisionRead the full story...Reprinted courtesy of