Colorado Governor Polis’s Executive Order D 2020 101: Keeping Up with Colorado’s Shifting Eviction Landscape during COVID-19

July 27, 2020 —

Luke Mecklenburg - Snell & Wilmer Real Estate Litigation BlogOn March 5, 2020, Colorado Governor Polis issues executive order D 2020 012, which among other things imposed temporary limitations on evictions, foreclosures, and public utility disconnections. After being amended and extended three times (through April 30, 2020 via D 2020-0131, then for an additional 30 days via D 2020 051, and finally for an additional 15 days from May 29, 2020 via D 2020 088), this executive order expired on Saturday, June 13, 2020.

In its stead, the Governor issued a more limited Executive Order—D 2020 101 (the “Order”)—which is effective through July 13, 2020. Most significantly, this current Order requires landlords to “provide tenants with thirty (30) days’ notice of any default for non payment” before they can initiate or file an eviction action (known as an “action for forcible entry and detainer,” or “FED”) and clarifies that tenants shall have the opportunity to cure any default for nonpayment during this period. The current Order also prohibits landlords and lenders “from charging any late fees or penalties for any breach of the terms of a lease or rental agreement due to non-payment” if the fees were incurred between May 1, 2020 and June 13, 2020.

Read the court decisionRead the full story...Reprinted courtesy of

Luke Mecklenburg, Snell & WilmerMr. Mecklenburg may be contacted at

lmecklenburg@swlaw.com

The Future for Tall Buildings Could Be Greener

October 01, 2013 —

CDJ STAFFSkidmore, Owens and Merrill made its reputation by creating iconic structures of steel, concrete, and glass, but in a new report, the firm puts forth ways in which the first item would be wood. Building codes in many cities stipulate that buildings taller than four stories be built of steel and concrete, but the firm says that it has come up with a way of building structures of 30 stories or more using wood.

The tallest wood-framed building currently is only ten stories tall. In order to calculate a comparison, Skidmore, Owens and Merrill designed a forty-two story building based on the design of an existing apartment building. Actually building it would require almost 4 million board-feet of wood. Unlike a typical single-family home (and its 20,000 board-feet of wood), these building would use glue-laminated timber and slabs.

The study found that the building would weigh less than half as much, allowing a less massive foundation. If the wood came from sustainable sources, its environmental impact would be drastically reduced. They calculated that instead of 9,500 tons of CO2 emissions for the conventional tower, the wood structure would be responsible for only 2,100 tons of emissions.

Skyscrapers will continue to be a feature of large cities. But instead of urban canyons of steel and concrete, in the future those towering buildings might be made of wood.

Read the court decisionRead the full story...Reprinted courtesy of

Repair of Part May Necessitate Replacement of Whole

February 10, 2012 —

CDJ STAFFJudge Gleuda E. Edmonds, a magistrate judge in the United States District Court of Arizona issued a ruling in Guadiana v. State Farm on January 25, 2012. Judge Edmonds recommended a partial summary judgment in favor of the plaintiff.

� Ms. Guandiana’s home had water damage due to pluming leaks in September 2004. She was informed that polybutylene pluming in her house could not be repaired in parts “it must be completely replaced.” She had had the plumbing replaced. State Farm denied her claim, arguing that “the tear-out provision did not cover the cost of accessing and replacing those pipes that were not leaking.”

� In September 2007, State Farm filed a motion to dismiss. The court rejected this motion, stating that “If Guadiana can establish as a matter of fact that the system that caused the covered loss included all the pipes in her house and it was necessary to replace all the pipes to repair that system, State Farm is obligated to pay the tear-out costs necessary to replace all the pipes, even those not leaking.”

� In March 2009, State Farm filed for summary judgment, which the court granted. State Farm argued that “the tear-out provision only applied to ‘repair’ and not ‘replace’ the system that caused the covered leak.” As for the rest of the piping, State Farm argued that “the policy does not cover defective materials.”

� In December 2011, Ms. Guadiana filed for summary judgment, asking the court to determine that “the policy ‘covers tear-out costs necessary to adequately repair the plumbing system, even if an adequate repair requires replacing all or part of the system.”

� In her ruling, Judge Edmonds noted that Ms. Guadiana’s claim is that “the water damage is a covered loss and she is entitled to tear-out costs necessary to repair the pluming system that caused that covered loss.” She rejected State Farm’s claim that it was not obligated to replace presumably defective pipes. Further, she rejected State Farm’s argument that they were only responsible for the leaking portion, noting “Guadiana intends to prove at trial that this is an unusual case where repair of her plumbing system requires replacement of all the PB plumbing.”

� Judge Edmonds concluded by directing the District Court to interpret the tear out issue as “the tear-out provision in State Farm’s policy requires State Farm to pay all tear-out costs necessary to repair the plumbing system (that caused the covered loss) even if repair of the system requires accessing more than the leaking portion of the system.”

Read the court’s decision…

Read the court decisionRead the full story...Reprinted courtesy of

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

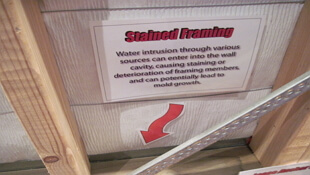

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

Home Prices in 20 U.S. Cities Increased 5% in Year to June

August 26, 2015 —

Michelle Jamrisko – BloombergHome prices in 20 U.S. cities climbed 5 percent in June from the same month a year earlier, a sign of more progress in the housing market.

The increase in the S&P/Case-Shiller index of property values matched the year-over-year gains in the prior three months, the group said Tuesday in New York. The median estimate of economists surveyed by Bloomberg called for a 5.1 percent year-over-year advance. Nationally, prices rose 4.5 percent.

Read the court decisionRead the full story...Reprinted courtesy of

Michelle Jamrisko, Bloomberg

Disputes Will Not Be Subject to Arbitration Provision If There Is No “Significant Relationship”

November 29, 2021 —

David Adelstein - Florida Construction Legal UpdatesAs you know from prior articles, arbitration is a creature of contract. This means if you want your disputes to be resolved by binding arbitration, as opposed to litigation, you want to make sure there is an arbitration provision in your contract. If there are certain types of disputes you do not want subject to arbitration, you want to specify those types of disputes/claims in your arbitration provision. If you are not sure, make sure to discuss the pros and cons of arbitration with your counsel when drafting and negotiating the contract. However, even with a broad arbitration provision, there are times where a dispute may still fall out of the scope of the arbitration provision, i.e., the dispute is not arbitrable. If this occurs, such dispute will be resolved by litigation. Parties that have buyer’s remove and do not want to arbitrate their dispute may try to make this argument that the dispute is not subject to the scope of the arbitration provision. There are times this argument carries weight because the dispute has no significant relationship to the agreement with the arbitration provision, as shown below.

In Deweees v. Johnson, 46 Fla. L. Weekly D2356b (Fla. 4th DCA 2021), a plaintiff purchased a home in a private residential community. The purchase contract with the developer contained a broad arbitration provision that materially provided that, “all post-closing claims, disputes, and controversies…between purchaser and seller will be resolved by binding arbitration except those arising under section G.5 and G.6 above.” Dewees, supra. Sections G.5 and G.6 provided that the purchaser will not interfere in the sales process with other purchasers and will not interfere with workmen during the construction process. There was also a workmanship and structural defect warranty for the dwelling that also contained an arbitration provision.

Read the court decisionRead the full story...Reprinted courtesy of

David Adelstein, Kirwin Norris, P.A.Mr. Adelstein may be contacted at

dma@kirwinnorris.com

Illinois Court Determines Duty to Defend Construction Defect Claims

March 22, 2021 —

Tred R. Eyerly - Insurance Law HawaiiGiven the underlying allegations of damage to personal property, the court determined the insurer had a duty to defend. Certain Underwriters at Lloyd's London v. Metropolitan Builders, Inc., 2019 Ill. App. LEXIS 979 (Ill. Ct. App. Dec. 18, 2019).

Metropolitan was hired as the general contractor for construction, renovation and demolition at contiguous properties - the 1907 Property, 1909 Property, and 1911 Property. During construction activities, the structures on the 1907 Property and 1909 Property collapsed. The existing structures on the properties were later deemed unsafe and were demolished by the city of Chicago.

AIG insured the owner of the buildings and paid over $1.8 million for repairs and associated expenses arising from the collapse. AIG then invoked its rights of subrogation against Metropolitan by filing suit. Metropolitan tendered the suit to its insurer, Lloyd's, who denied coverage and filed for a declaratory judgment. The trial court found the underlying complaint alleged property damage, but not an occurrence. Summary judgment was awarded to Lloyd's.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Damon Key Leong Kupchak HastertMr. Eyerly may be contacted at

te@hawaiilawyer.com

New York Instructs Property Carriers to Advise Insureds on Business Interruption Coverage

April 13, 2020 —

Tred R. Eyerly - Insurance Law HawaiiThe New York Department of Financial Services (DFS) took the unusual step last week of instructing all property/casualty insurers to provide information on commercial property insurance and details on business interruption coverage in light of the COVID-19 outbreak. The notice is

here.

The notice recognizes that policyholders have urgent questions about the business interruption coverage under their policies. Insurers must explain to policyholders the benefits under their policies and the protections provided in connection with COVID-19.

The explanation to policyholders is to include the following relevant information.

What type of commercial property insurance or otherwise related insurance policy does

the insured hold?

Does the insured's policy provide "business interruption" coverage? If so, provide the

"covered perils" under such policy. Please also indicate whether the policy contains a

requirement for "physical damage or loss" and explain whether contamination related

to a pandemic may constitute "physical damage or loss." Please describe what type of

damage or loss is sufficient for coverage under the policy.

Read the court decisionRead the full story...Reprinted courtesy of

Tred R. Eyerly, Damon Key Leong Kupchak HastertMr. Eyerly may be contacted at

te@hawaiilawyer.com