Professional Liability Alert: Joint Client Can't Claim Privilege For Communications With Attorney Sued By Another Joint Client

February 05, 2015 —

David W. Evans and Stephen J. Squillario – Haight Brown & Bonesteel LLPIn Anten v. Superior Court (No. B258437 – Filed 1/30/2015), the Second Appellate District held that when joint clients do not sue each other, but one of them sues their former attorney, the nonsuing client cannot prevent the parties to the malpractice suit from discovering or introducing otherwise privileged attorney-client communications made in the course of the joint representation.

Under California Evidence Code §958, in lawsuits between an attorney and a client based on an alleged breach of a duty arising from their attorney-client relationship, communications relevant to the alleged breach are not protected by the attorney-client privilege. Similarly, Evidence Code §962 provides that if multiple clients retain or consult with an attorney on a matter of common interest and the joint clients later sue each other, then the communications between either client and the attorney made in the course of that relationship are not privileged in the suit between the clients.

Reprinted courtesy of

David W. Evans, Haight Brown & Bonesteel LLP and

Stephen J. Squillario, Haight Brown & Bonesteel LLP

Mr. Evans may be contacted at devans@hbblaw.com; Mr. Squillario may be contacted at ssquillario@hbblaw.com

Read the court decisionRead the full story...Reprinted courtesy of

The Sky is Falling! – Or is it? Impacting Lives through Addressing the Fear of Environmental Liabilities

March 30, 2016 —

John Van Vlear and Karl Foster – Newmeyer & Dillion, LLPSix months ago, a couple anxiously relayed to N&D lawyers how the sky was falling – with environmental liabilities at the center of their seemingly real Chicken Little fears. The couple owned two properties in a central California town, one being a former gas station which an oil company had abandoned alleging the lease was void given partial eminent domain actions. Before interviewing us, the couple had spent in excess of $100,000 in legal fees with another law firm trying to force the oil company to take responsibility for potential environmental impacts under the disputed lease.

Reprinted courtesy of

John Van Vlear, Newmeyer & Dillion, LLP and

Karl Foster, Newmeyer & Dillion, LLP

Mr. Van Vlear may be contacted at john.vanvlear@ndlf.com.

Mr. Foster may be contacted at karl.foster@ndlf.com

Read the court decisionRead the full story...Reprinted courtesy of

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

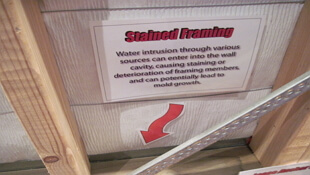

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

San Diego: Compromise Reached in Fee Increases for Affordable Housing

October 01, 2014 —

Beverley BevenFlorez-CDJ STAFFA San Diego City Council committee has forwarded a revised plan to increase affordable housing in the city, which reduces the linkage fees increases, reported the U-T San Diego. The first proposal would have increased linkage fees by five times, while this new plan doubles current fees.

The Times of San Diego reported that “[t]he fee had been halved in 1996 as an economic stimulus and was supposed to be reviewed annually, but wasn't.” However, Andrea Tevlin, the city of San Diego’s Independent Budget Analyst, estimated that “costs on developers would have jumped 400 percent to more than 700 percent, depending on the type of project.”

The new proposal also contains exemptions for “developers of manufacturing facilities, warehouses and nonprofit hospitals from paying any fees at all,” according to U-T San Diego. “Developers of research and science-related projects would still have to pay fees, but they would be exempt from the proposed increase.”

However, not everyone is satisfied by the compromise. “While the November 2013 proposal went too far, this new proposal doesn’t go far enough,” Tevlin told U-T San Diego. The vote had been deadlocked, 2-2, but will be forwarded to the main council because Republican Lori Zapf, committee chair, could break the tie.

The new plan “created jointly by the San Diego Housing Commission and a group of business leaders called the Jobs Coalition, would increase the linkage fees’ annual yield from $2.2 million to an estimated $3.7 million and allow construction of 37 affordable housing units per year instead of 22,” U-T San Diego reported.

Read the full story, U-T San Diego...

Read the full story, Times of San Diego... Read the court decisionRead the full story...Reprinted courtesy of

OH Supreme Court Rules Against General Contractor in Construction Defect Coverage Dispute

October 30, 2018 —

Theresa A. Guertin - Saxe Doernberger & Vita, P.C.On October 9, 2018, the Ohio Supreme Court issued a decision in Ohio Northern University v. Charles Construction Services, Inc., Slip Op. 2018-Ohio-4057, finding that a general contractor was not entitled to defense or indemnity from its CGL insurer in a construction defect suit brought by a project owner post-project completion. With this decision, Ohio has solidified its place amongst a diminishing number of states, including Pennsylvania and Kentucky, which hold that there is no coverage for defective construction claims because those losses do not present the level of fortuity required to trigger CGL coverage. This places Ohio amongst the worst in the country on this issue at a time when numerous states have abandoned old precedent and moved towards a policyholder friendly analysis.

Ohio Northern University (“ONU”) hired Charles Construction Services, Inc. (“CCS”) to construct the University Inn and Conference Center, a new hotel and conference center on their campus in Ada, Ohio. CCS purchased CGL insurance from Cincinnati Insurance Company (“CIC”) insuring the project. Following completion of the project, ONU sued CCS alleging defects in the construction of the completed project, including allegations that windows improperly installed by one subcontractor led to damage to walls built by another subcontractor. CIC agreed to defend CCS under a reservation of rights but intervened in the action between ONU and CCS to pursue a declaratory judgment that it had no obligation to defend or indemnify its insured for the alleged losses.

Read the court decisionRead the full story...Reprinted courtesy of

Theresa A. Guertin, Saxe Doernberger & Vita, P.C.Ms. Guertin may be contacted at

tag@sdvlaw.com

Homebuilders Call for Housing Tax Incentives

May 10, 2013 —

CDJ STAFFThe National Association of Home Builders has asked Congress to support tax incentives for home buyers and renters, including the Low Income Housing Tax Credit and the mortgage interest deduction. Robert Dietz, an economist at the NAHB, noted that in 2009, 35 million home owners were able to claim the mortgage deduction. Dietz responded to arguments that the deduction simply lead to people buying bigger homes by saying that “the need for a larger home created the higher loan deduction, not the other way around.”

The NAHB notes that one hundred new single-family homes creates more than 300 jobs and generates substantial tax revenues. “Housing provides the momentum behind an economic recovery because home building and associated businesses employ such a wide range of workers” said Dietz.

Read the court decisionRead the full story...Reprinted courtesy of

Biden Administration Issues Buy America Guidance for Federal Infrastructure Funds

April 25, 2022 —

Garret Murai - California Construction Law BlogAs you know, late this past year Congress passed and President Biden signed the largest infrastructure bill since President Franklin D. Roosevelt’s “New Deal” in 1933. The infrastructure bill provides $1.2 trillion in spending on the nations’ infrastructure over the next five years.

On Monday, the Biden Administration issued Initial Implementation Guidance requiring that, beginning May 14, 2022, materials paid for with infrastructure bill funds be made in America. The Guidance, which implements the “Buy America” provisions of the infrastructure bill requires that:

1. All iron and steel used in a project be produced in the United States;

Read the court decisionRead the full story...Reprinted courtesy of

Garret Murai, Nomos LLPMr. Murai may be contacted at

gmurai@nomosllp.com

Certain Private Projects Now Fall Under Prevailing Wage Laws. Is Yours One of Them?

November 21, 2022 —

Nancy Cox - Construction ExecutiveFor the last few years, New York State Labor Law has required that all contractors overseeing public development projects pay their workers the prevailing wage rate, which includes a regulated hourly rate for wage and benefits. Fast forward to 2022, the requirements of Section 224-A are extending to private projects costing more than $5 million where 30% or more of the financing for the construction costs was obtained from public sources like state or local funding.

There are a number of forms of financing that qualify as public funding, and its important for developers to understand exactly how these are defined under the new law. Public funding includes any indirect or direct payment from government authorities, savings from fees, tax credits or payments in lieu of taxes, loans from public entities and more.

In order to provide further clarity, the law also clearly defined certain project exemptions to the new rule. First, affordable housing projects will not be affected, along with historic rehabilitation projects or small renewable energy projects. Also, projects for established non-profit companies receive an exemption as long as the company reports gross annual revenues less than $5 million. Other exemptions include projects for schools under 60,000 square feet and those funded by the Urban Development Corporation’s Restore New York's Communities Initiative.

Reprinted courtesy of

Nancy Cox, Construction Executive, a publication of Associated Builders and Contractors. All rights reserved.

Read the court decisionRead the full story...Reprinted courtesy of