Fifth Circuit: Primary Insurer Relieved of Duty to Defend Without Release of Liability of Insured

March 02, 2020 —

Bethany L. Barrese & Ashley McWilliams - Saxe Doernberger & Vita, P.C.In Aggreko, LLC v. Chartis Specialty Ins. Co.,1 the Fifth Circuit affirmed a decision by the Texas District Court and held that a Covenant Not to Execute constituted a “settlement” sufficient to exhaust policy limits and terminate a primary insurer’s duty to defend.

This case arose out of a wrongful death suit filed by the parents of James Brenek II (“Brenek”). In 2014, Brenek was fatally electrocuted by an electrically energized generator housing cabinet while performing work on a rig in Texas for Guichard Operating Company, LLC (“Guichard”), a Louisiana-based drilling subcontractor. Guichard had leased the generator from Aggreko, LLC (“Aggreko”). A rental agreement between Guichard and Aggreko required Guichard to maintain commercial general liability insurance during the lease period and list Aggreko and the rig owner, Rutherford Oil Corporation (“Rutherford”), as additional insureds under

the policy.

Guichard’s primary insurance carrier, The Gray Insurance Company (“Gray”), agreed to defend and indemnify Aggreko and Rutherford in the wrongful death suit. The Gray policy had a limit of $1,000,000, subject to a $50,000 self-insured retention.

Reprinted courtesy of

Bethany L. Barrese, Saxe Doernberger & Vita, P.C. and

Ashley McWilliams, Saxe Doernberger & Vita, P.C.

Ms. Barrese may be contacted at blb@sdvlaw.com

Ms. McWilliams may be contacted at amw@sdvlaw.com

Read the court decisionRead the full story...Reprinted courtesy of

Florida extends the Distressed Condominium Relief Act

June 17, 2015 —

Beverley BevenFlorez-CDJ STAFFThe Distressed Condominium Relief Act had been poised to expire on July 1st, but has now been extended by two additional years by the Florida legislature, the National Review reported. The act was Part VII of the Condominium Act in 2010, and has been previously extended twice. According to the National Review, “This Legislation attempted to allay the fears of potential investors about incurring developer liability in connection with the purchase of bulk units. The Act created a shield in favor of bulk purchasers from such potential liability, especially construction defects liability.”

Read the court decisionRead the full story...Reprinted courtesy of

Beverly Hills Voters Reject Plan for Enclave's Tallest Building

November 10, 2016 —

James Nash – BloombergA costly battle over development in Beverly Hills, California, ended with voters rejecting a hotel owner’s proposal to combine two planned condominium towers into a single building that would have loomed over the wealthy Southern California enclave.

With 44 percent in support and 56 percent against, Beverly Hills voters turned down plans by Beny Alagem, who owns the Beverly Hilton and is building an adjacent 170-room Waldorf Astoria, to develop a single 26-story tower next to the hotels, instead of eight- and 18-story buildings that were approved by the city council and a voter referendum in 2008. Alagem’s plan sets aside the remaining 1.7 acres (0.7 hectares) for a public park and gardens.

Read the court decisionRead the full story...Reprinted courtesy of

James Nash, Bloomberg

20 Years of BHA at West Coast Casualty's CD Seminar: Chronicling BHA's Innovative Exhibits

May 03, 2018 —

Beverley BevenFlorez-CDJ STAFFThe Bert L. Howe & Associates, Inc., (BHA) exhibit has been a fixture at West Coast Casualty's Construction Defect Seminar since the mid-1990's. Through the years, BHA has updated their display, but no matter what year, you could count on the BHA exhibit to provide a not-to-be-missed experience.

2008-BHA's sleek, rear projection display includes a screen that promotes the firm's capabilities that can be seen throughout the exhibit hall. This would be one of many innovations BHA has brought to the West Coast Casualty seminar.

2009-With the success of the rear screen projection, BHA adds additional monitors to provide attendees with more information about BHA.

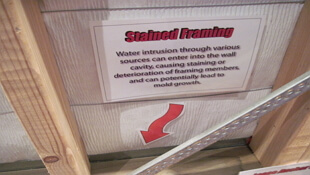

2010-BHA adds an interpretive professional development exhibit targeted to Building Envelope issues allowing adjusters and other non-construction professionals hands on access to the systems and components at the heart of many related such claims.

2011-BHA's Swing for Charity challenge is born.

2012-Always innovating, BHA expands its rear projection and professional development offerings to West Coast attendees.

2013-BHA showcases additional capabilities with a twenty-four foot, custom, convex, immersive video experience.

2014-BHA adds an iPhone display to give a hands-on demonstration of their data collection methods.

2015-BHA's twenty-four foot , custom, convex, immersive video experience was elevated with two additional rear projection screens, reflecting BHA's newest capabilities and services.

2016-BHA dazzles attendees with their new exhibit comprised of more than 15 integrated, high definition, LCD displays. iPads are stationed on tables to conveniently demonstrate BHA's data collection processes.

2017-BHA's Swing for Charity Golf Challenge raised $2,225.00 for the National Coalition for Homeless Veterans and $1,900 for Final Salute.

Read the court decisionRead the full story...Reprinted courtesy of

Insurers in New Jersey Secure a Victory on Water Damage Claims, But How Big a Victory Likely Remains to be Seen

April 03, 2019 —

Kevin Sullivan - TLSS Insurance Law BlogProperty insurance policies commonly cover water damage caused by an accidental discharge or leakage of water from an on-site plumbing system and commonly exclude water damage caused by a sewer backup. So it’s not surprising that the cause of water damage is a common battleground between policyholders and insurers. In Salil v. Ohio Security Insurance Co., 2018 WL 6272930 (N.J. App. Div. Dec. 3, 2018), insurers scored a victory when the court held that the release of water and sewage into a restaurant was subject to a $25,000 sublimit for water damage caused by a sewer backup. But claims adjusters and policyholders confronted with water damage claims in New Jersey will no doubt continue to do battle over whether the Salil decision was a decisive victory for insurers or a limited one.

In Salil, the insured landlord leased its building to a restaurant operator. After the insured’s tenant reported water and odor at the restaurant, the insured contacted a plumber, who informed the insured that a clog in the restaurant’s toilet caused Category 3 water to flow into the restaurant. The insured allegedly sustained approximately $160,000 in restoration costs and loss of business income. The plumber used a snake to clear the sewer line to remedy the issue. The restoration company confirmed the cause of the loss was a sewer back up. On this basis, the insurer determined that the cause of loss was a sewer backup. The policy excluded coverage for water damage caused by a sewer back-up, but an endorsement restored that coverage, subject to a $25,000 sub-limit for “direct physical loss or damaged caused by water… which backs up into a building or structure through sewers or drains which are directly connected to a sanitary sewer or septic system.” Pursuant to this endorsement, the insurer paid its $25,000 sublimit.

Read the court decisionRead the full story...Reprinted courtesy of

Kevin Sullivan, Traub LiebermanMr. Sullivan may be contacted at

ksullivan@tlsslaw.com

Brad Pitt’s Foundation Sues New Orleans Architect for Construction Defects

September 25, 2018 —

David Suggs – Bert L. Howe & Associates, Inc.Brad Pitt’s foundation has sued its architect of New Orleans projects alleging “defective design work led to leaks and other flaws in homes built for residents of an area that was among the hardest hit by Hurricane Katrina,” reported Insurance Journal.

The Make It Right Foundation claims damages of more than $15 million caused by architect John C. Williams. According to Insurance Journal, “The foundation paid Williams’ firm millions of dollars to produce architectural drawings for more than 100 homes under the program, which was supposed to provide Lower 9th Ward residents with sustainable and affordable new homes.”

This lawsuit against the architect is apparently in response to a class-action lawsuit by New Orleans attorney Ron Austin against Pitt’s Make It Right Foundation. Austin’s lawsuit “accused the charity of building substandard homes that are deteriorating at a rapid pace,” Insurance Journal reported.

The 39 homes involved in a previous suit regarding the manufacturer of TimberSIL are excluded from the lawsuit against Williams.

Read the court decisionRead the full story...Reprinted courtesy of

Terminating A Subcontractor Or Sub-Tier Contractor—Not So Fast—Read Your Contract!

May 24, 2018 —

John P. Ahlers - Ahlers Cressman & Sleight PLLC BlogEvery few months I receive a call from a general contractor or subcontractor who has just terminated a subcontractor or sub-tier contractor for non-performance and is “checking in with me to see if there are any liability issues.” After the termination has taken place, if the termination is wrongful, there are serious legal consequences. Calling your lawyer after the fact will not cure missteps in the termination process. Termination for non-performance is a common term in most contract documents. As courts interpret contracts, however, the right to earn revenue from a contract is a substantial interest, and courts generally “abhor” forfeitures (termination) of that right. In other words, the courts will strictly determine whether the terminating party to a contract has complied with the termination process to the letter. A recent example from Connecticut is instructive in this regard. [1]

The general contractor on a large hospital project in Connecticut terminated its electrical subcontractor, hired others to finish the electrical subcontractor’s work, and then sued the electrical subcontractor for $26 million. The electrical subcontractor countersued the general contractor for $3.6 million of work that it had completed at the time of the termination which had not been paid for. The subcontractor claimed that due to the many changes that had occurred on the project, it stopped work because the changes altered the contract to the point that it was no longer the same contract. The subcontractor walked off the project and the general contractor then terminated the subcontractor and re-procured the work from other subcontractors.

Read the court decisionRead the full story...Reprinted courtesy of

John P. Ahlers, Ahlers Cressman & Sleight PLLCMr. Ahlers may be contacted at

john.ahlers@acslawyers.com

NTSB Issues 'Urgent' Recommendations After Mass. Pipeline Explosions

November 28, 2018 —

Tom Ichniowski – Engineering News-RecordThe National Transportation Safety Board has issued urgent safety recommendations in the wake of September’s natural-gas explosions and fires in the Merrimack Valley area of Massachusetts that killed one person and resulted in at least 21 others, including two firefighters, going to the hospital.

Read the court decisionRead the full story...Reprinted courtesy of

Tom Ichniowski, ENRMr. Ichniowski may be contacted at

ichniowskit@enr.com